Imagine yourself standing before a treasure chest overflowing with gold and jewels.Excitement surges, but without a map or a key, all that potential wealth remains tantalizingly out of reach. Financial statements are, in essence, the map and key to unlocking the mysteries behind any business treasure chest – from the corner bakery to a multinational corporation. While they might initially appear as a perplexing jumble of numbers and jargon, understanding these crucial documents empowers you to navigate the financial landscape, make informed decisions, and ultimately, unlock the power held within those figures. This journey will demystify the art of reading financial statements, transforming them from intimidating documents into invaluable tools for financial mastery. Let’s begin.

Table of contents

- Decoding the balance Sheet: A Snapshot of Your Assets and Liabilities

- Unraveling the Income Statement: Tracking Your Revenue and Expenses

- Cash Flow Statement Secrets: Mapping Your Movement of Funds

- Ratio Analysis Unveiled: Key Metrics for Financial Health

- forecasting the Future: Projecting Performance with Financial Statements

- Actionable Insights: Using Statements to achieve Your Financial Goals

- Q&A

- In Retrospect

Decoding the Balance Sheet: A Snapshot of Your Assets and Liabilities

Imagine peering into a financial mirror, reflecting everything your business owns and owes at a single point in time. That’s essentially what the balance sheet does. Its a critical component of your financial statements, offering a structured overview represented by the essential accounting equation: Assets = Liabilities + Equity. Analyzing it helps you understand your company’s financial health and stability. This insight isn’t just for accountants; it’s crucial for every business owner, investor, or stakeholder wanting to gauge the financial standing of an organization.

The beauty of the balance sheet lies in its clarity and structure. It’s organized into three distinct sections, each providing vital data:

- Assets: What the business owns, like cash, accounts receivable, inventory, and equipment. Assets represents the resources available to generate future income.

- Liabilities: What the business owes to others, such as accounts payable, salaries payable, and loans. Liabilities represent creditors’ claims of the company’s assets.

- Equity: The owner’s stake in the business, representing the residual value after subtracting liabilities from assets. equity showcases the owner’s investments and retained earnings.

| Asset Type | Example |

|---|---|

| Current Asset | Cash |

| Non-Current asset | Equipment |

| Liability Type | Example |

| Current Liability | Accounts Payable |

| Non-Current Liability | Long-term Loan |

Unraveling the Income Statement: Tracking Your Revenue and Expenses

Let’s decode the mystery behind one of the moast vital financial documents: the income statement! Think of it as the business’s report card for a specific period. It meticulously tracks all the money flowing in (revenue) and all the money flowing out (expenses). By subtracting expenses from revenue, we arrive at the all-important net income (or net loss). This single figure provides a snapshot of your company’s profitability. But there’s more! The income statement also reveals key performance indicators (kpis) that can definitely help you fine-tune your business strategies. Need to boost sales? Reduce costs? The income statement provides the insights you need to make informed decisions.

Ready to dive deeper? Here are some important components you’ll find on many businesses’ income statements:

- Revenue: The total amount of money earned from sales.

- cost of Goods Sold (COGS): The direct costs associated with producing or acquiring goods for sale.

- Gross Profit: Revenue minus COGS – your profit before operating expenses.

- operating Expenses: Costs incurred in running the business,such as salaries,rent,and marketing.

- net Income: The “bottom line” – the final profit after all expenses have been deducted.

To give you a clearer picture, take a look at this simplified example:

| Item | Amount ($) |

|---|---|

| Revenue | 100,000 |

| COGS | 30,000 |

| Gross Profit | 70,000 |

| Operating Expenses | 40,000 |

| Net Income | 30,000 |

Cash Flow Statement Secrets: Mapping Your Movement of Funds

Ever feel like your business is making money, but you’re constantly strapped for cash? That’s were the Cash flow Statement swoops in like a financial superhero. It’s not enough to know you’re generating revenue; you need to understand how that money is moving – where it’s coming from,where it’s going,and the timing of it all. This statement strips away the complexities of accrual accounting and shows you the raw, unvarnished truth about your cash inflows and outflows. Think of it as a detailed itinerary for your company’s money, revealing precisely how it navigates the daily operations, investments, and financing activities.

Decoding this statement unlocks a powerful understanding of your company’s financial health. Here’s a little taste of what insights you can get:

- Operational Efficiency: How well are you managing your day-to-day business operations and revenues?

- Investment Strategies: Is your investment strategy actually generating cash, or is it draining your resources?

- Financing Health: Are you reliant on debt to stay afloat, or are you generating healthy autonomous cash flow?

To showcase a very simple example of a Cash Flow Statement:

| Cash Flow Category | Amount |

|---|---|

| Cash from Operations | $50,000 |

| Cash from Investing | -$20,000 |

| Cash from Financing | $10,000 |

| Net increase in cash | $40,000 |

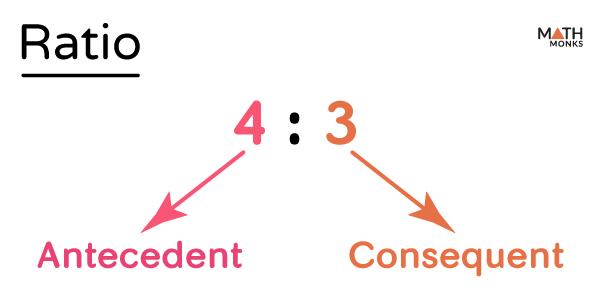

Ratio Analysis Unveiled: key Metrics for Financial health

Embark on a journey to decipher the language of business! Financial statements aren’t just rows and columns of numbers; they are powerful stories waiting to be told. They reveal a company’s past performance, present condition, and potential future. Think of them as a business’s medical chart, vital signs displayed for astute observers.Grasping the essentials – balance sheets, income statements, and cash flow statements – unlocks the door to understanding more complex financial analysis.

Once you can read these financial reports, you’re ready for ratio analysis, an essential tool for interpreting the information contained within. Explore how different metrics offer insights. Such as, consider liquidity:

- current Ratio: A speedy assessment of a company’s ability to meet short-term obligations.

- Quick Ratio (or Acid-Test Ratio): A more conservative measure of immediate liquidity.

Or profitability:

- Gross Profit Margin: How efficiently a company generates profit from its products or services

- Net Profit Margin: Overall profitability after accounting for all expenses.

And what about debt management?:

- Debt-to-Equity Ratio: Indicates the proportion of debt and equity a company is using to finance its assets.

- Times Interest earned Ratio: Measures a company’s ability to cover its interest expenses with its operating income.

Let’s zoom into a quick example showcasing how ratios can easily assess and benchmark a company’s performance:

| Ratio | Company A | Company B | industry Average |

|---|---|---|---|

| Current Ratio | 1.8 | 2.5 | 2.0 |

| Net Profit Margin | 8% | 12% | 10% |

Company B seems to be in a better short-term financial health condition and more profitable when compared to Company A, and, additionally, they closely follow the industry average. Mastering financial statement analysis through ratio analysis can illuminate investment opportunities, evaluate creditworthiness, and drive sound business decisions.

Forecasting the Future: Projecting Performance with Financial Statements

Imagine financial statements as the blueprints of a company. They don’t just tell you what happened; they hint at what could happen. By dissecting the Income Statement, Balance Sheet, and Cash flow Statement, we can piece together a narrative that helps us anticipate future performance. These aren’t mystical oracles; they’re logical frameworks showing how resources are deployed, what income is generated, and how cash moves through the organization. Think of it as detective work where the clues are figures and ratios, leading us to plausible scenarios of growth, stability, or potential pitfalls.

But how exactly do we translate these snapshots into predictions? it starts with understanding the core components and applying forecasting techniques. this involves everything from simple trend analysis to complex regression models.Such as, let’s say a company has been consistently increasing its sales by 10% each year. Assuming market conditions remain stable, we can project a similar growth rate by analyzing the evolution of financial information:

| Year | sales (Millions) | Growth Rate |

|---|---|---|

| 2021 | $10.0 | – |

| 2022 | $11.0 | 10% |

| 2023 | $12.1 | 10% |

| 2024 (Projected) | $13.3 | 10% |

Understanding these statements opens doors to informed estimations, which are necessary for future planning. It helps anticipate potential opportunities and challenges.

Actionable Insights: Using Statements to Achieve your Financial Goals

Ever feel like your financial journey is a winding road with no map? Financial statements are your map, compass, and GPS all rolled into one! Demystifying these documents transforms them from intimidating spreadsheets into powerful tools. They hold the keys to unlocking your earning potential, optimizing spending, and building a robust path toward your ambitions. Think of them as a detective novel – each number is a clue, and you’re the financial sleuth cracking the case of your own money matters. Let’s get started with the most important actions:

- Income Statement Analysis: Reveals where your money is coming from and where it’s going.

- Balance Sheet Review: A snapshot of your assets, liabilities, and equity at a specific time.

- Cash Flow Statement: Tracks the actual movement of cash in and out of your accounts.

Ready to turn those insights into actions? Imagine easily spotting areas where you’re overspending (goodbye,daily gourmet coffee!) or identifying opportunities to increase your income (hello,freelance writing side hustle!). Let’s consider an example. Let’s say that reviewing your Income Statement (one element from a financial statement) shows you are spending a lot on eating-out occasions. Now,you can target that problem and you can track it within the same statement at the end of the month! Here’s a table showing how to quickly create habits and track them for your financial success.

| Month | Eating-out Spending | Target Actions | real Results |

|---|---|---|---|

| january | $300 | Reduce to $150 | $200 |

| February | $200 | Reduce to $100 | $120 |

| March | $120 | Maintain at $100 | $90 |

This data would not be available without the proper analysis of just one element of your financial statements.

The ability to understand your financial statements empowers you to make informed decisions, adjust your course as needed, and ultimately steer yourself toward the financial future you desire.

Q&A

Decoding the Dollar Dance: A Q&A to Unravel Financial Statements

Financial statements. They sound intimidating, right? Like ancient scrolls decipherable only by tweed-clad wizards. But fear not! Think of them as the colorful maps guiding you through the financial landscape of a business. to decode these maps, we’ve got some answers to the questions swirling around in your mind. Let’s jump in!

Q: Imagine I’m fully new to this. What exactly are financial statements? Are we talking spreadsheets overflowing with numbers?

A: think of them as a business’s personal diary, but rather of writing about crushes, they chronicle its financial activities. They’re structured documents – typically, we’re talking spreadsheets, yes! – that tell a story about how a company is performing. The most common are the Income Statement, the Balance Sheet, and the Cash Flow Statement. Each provides a unique angle, painting a comprehensive picture when viewed together.

Q: Alright, so three diary entries. Tell me a little more about each. What secrets do they hold?

A: Consider these the ”Who, What, and Where” of financial performance:

The Income Statement (“Profit & Loss”): This is the “What happened?” It shows a company’s profitability over a specific period. Think “revenue minus Expenses equals Profit (or Loss).” It’s a scorecard for operational efficiency.

The Balance Sheet (“Statement of financial Position”): This is the “Where are we standing?” It’s a snapshot of a company’s assets (what it owns), liabilities (what it owes), and equity (the owners’ stake) at a specific point in time. Imagine a frozen moment in the company’s financial journey.

The cash Flow Statement: This is the “how did we move?” It tracks the movement of cash both into and out of a company. It’s all about understanding liquidity - can the company pay its bills on time?

Q: Okay,I’m starting to see the connections. But why shoudl I even care? I’m not running a Fortune 500 company!

A: Understanding financial statements is useful far beyond managing a global enterprise. Weather you’re an individual investor,a small business owner,or simply someone curious about the world around you,the ability to read these reports unlocks incredible insights. Thinking of buying a stock? financial statements tell you if the company is healthy. Considering a new job? See if the company is financially stable. Even when considering donating to a non-profit, you can review their financial statements to understand how responsibly they are managing donations. It’s a superpower for making informed decisions.

Q: so,I pick up a Balance Sheet. It’s got sections I’ve never seen before.”Assets,” “liabilities,” ”Equity” – what gives?

A: Let’s break those down into everyday terms:

Assets: Everything of value that the company owns. Think cash, buildings, equipment, inventory – even trademarks and patents!

Liabilities: What the company owes to others. Loans, unpaid bills, future lease obligations – anything that represents a future outflow of cash.

Equity: The owner’s “share” in the company. It’s what’s left over after you subtract liabilities from assets. In a way, it signifies the net worth of the company as seen by its owners.

Q: Are there some key metrics or ratios that I should absolutely pay attention to when analyzing these statements?

A: Absolutely! Here are a few to get you started. Think of them as the highlights reel of financial performance:

Profit Margin (from the Income Statement): How much profit a company makes for every dollar of revenue. A higher margin is generally better.

debt-to-Equity Ratio (from the Balance Sheet): How much debt a company uses to finance its operations compared to its equity. A high number can be a red flag.

Current Ratio (from the Balance Sheet): The ability of a company to pay its short-term obligations with its short-term assets. A higher number, generally above 1, is indicative of liquid health.

Q: This sounds like a lot of work. Is it difficult to learn how to analyze these statements properly?

A: Like learning a new language, it takes time and practice. Start by understanding the basic concepts. Don’t be afraid to explore online resources, take courses, or consult with a financial advisor. The more you practice, the more confident you’ll become at uncovering valuable insights hidden within those numbers.

Q: are there any common pitfalls or mistakes people make when trying to understand financial statements?

A: Yes! here are a couple big ones:

Focusing on a single statement: Remember, they tell a collective story. Analyzing them in isolation can lead to a skewed understanding.

Comparing apples to oranges: Industry context is crucial! Comparing the financials of a tech startup to a brick-and-mortar retailer is like comparing, well, apples to oranges!

Ignoring the Notes to the Financial Statements: The footnotes often contain key information or can explain notable deviations or changes within the statements.

So, there you have it! Financial statements might seem complex, but armed with a little knowledge, you can unlock their secrets and gain a powerful understanding of the financial world.Now go forth and decode!

In Retrospect

So, you’ve now peeked behind the curtain of the grand financial theater. You’ve seen the actors (assets, liabilities, equity), witnessed their performance (income statement), and observed the ebbs and flows of their resources (cash flow statement).

Understanding these statements isn’t just about crunching numbers; it’s about deciphering a compelling narrative. It’s about recognizing the strengths, anticipating the challenges, and ultimately, making more informed decisions, whether you’re charting the course of a business empire or simply navigating your own financial journey.

Armed with this knowledge, you’re no longer just watching the financial show. You’re now an active participant, ready to truly understand the story being told. Keep learning, keep exploring, and remember that the world of finance is constantly evolving. Your journey has just begun!