In a world where financial health is often measured by a single number, the conversation around money frequently centers on credit scores—a figure that can dictate everything from loan approvals to interest rates. Though, the journey to financial wellness encompasses far more than what a three-digit score can convey.It involves a holistic understanding of personal finances, encompassing savings, investments, budgeting, and emotional well-being.In this article, we will explore the multifaceted nature of financial wellness, uncovering vital concepts that extend beyond credit scores. Join us as we unlock the keys to achieving a balanced and sustainable financial future, empowering you to take charge of your financial destiny with confidence and clarity.

Exploring the Holistic Approach to Financial Health

Financial health extends far beyond the confines of credit scores and debt management. It encompasses a broader spectrum of well-being that includes not only tangible assets but also emotional and psychological aspects associated with financial decision-making. Recognizing this multidimensional approach can significantly enhance one’s journey towards financial wellness.

To truly grasp financial health, consider these interconnected elements that contribute to a holistic perspective:

- Income Stability: Having a stable and reliable income stream sets the foundation for all other financial health aspects.

- Emergency Savings: Accumulating a cushion for unexpected expenses helps reduce financial stress.

- Debt Management: understanding the difference between healthy and unhealthy debt is crucial for financial stability.

- Investment Knowledge: being educated about investment options enables smarter decisions about future financial growth.

- Financial Literacy: Improving your understanding of financial principles enhances overall decision-making capabilities.

A significant aspect of this holistic approach is emotional awareness. Money can often evoke strong emotions ranging from anxiety to joy. Developing a healthy relationship with money means addressing these emotions and how they influence financial choices. Strategies may include setting realistic financial goals, practicing mindful spending, and regularly evaluating one’s financial behaviors and beliefs.

Moreover, relationships play a vital role in shaping financial health. the support system surrounding an individual can provide encouragement and guidance, serving as a buffer against financial stress.Consider using the following framework for assessing the role of relationships in financial health:

| Relationships | Impact on Financial Health |

|---|---|

| family | Shared financial goals and support in times of crisis |

| Friends | Peer influences on spending habits and investments |

| Financial Advisors | Expert guidance for long-term strategies and investments |

Identifying key Elements Beyond the Credit Score

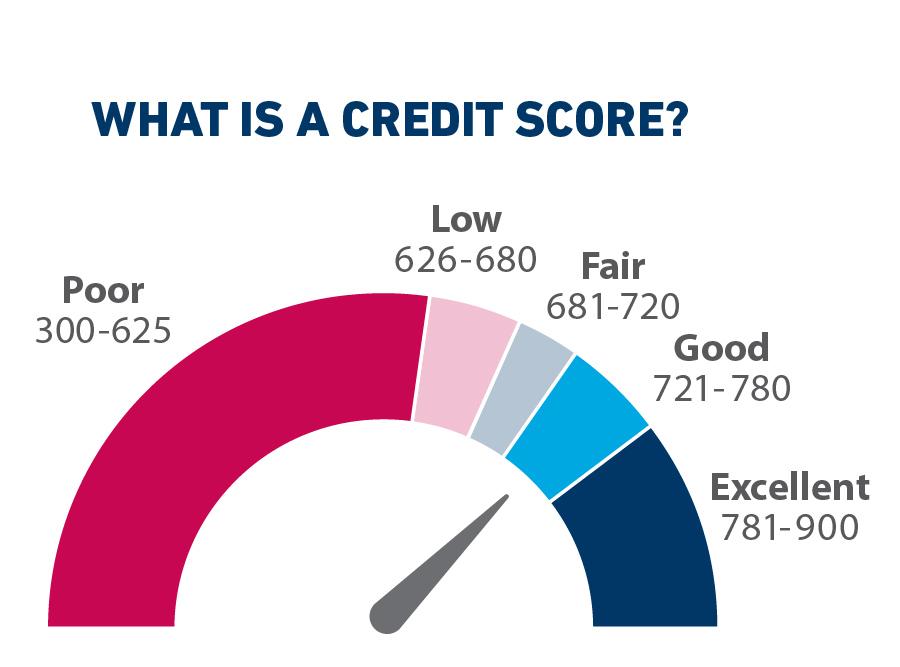

When embarking on your journey toward financial wellness, it’s essential to broaden your perspective beyond the confines of a credit score. While a credit score undoubtedly plays a significant role in determining your financial health, other factors can significantly impact your overall financial well-being. Understanding and assessing these elements can offer a more thorough picture of your financial landscape.

Income stability, savings habits, and spending behaviors are basic components that can influence your financial status. A high credit score may indicate responsible borrowing, but if your income fluctuates significantly or if you lack substantial savings, you might find yourself vulnerable during unforeseen events. Consider evaluating the following:

- Monthly income consistency: Is your income stable or does it vary greatly?

- Emergency savings: Do you have enough set aside to cover three to six months’ worth of expenses?

- Spending patterns: Are your spending habits aligned with your financial goals?

Additionally, another vital aspect is your debt-to-income ratio (DTI), wich assesses how well you manage your debt relative to your income. A low DTI suggests that you are not over-leveraged and have enough disposable income to cover your obligations. This metric can often play a more decisive role in lending decisions than your credit score alone. The following table summarizes the categories of debt-to-income ratios:

| Debt-to-income Ratio Category | Percentage |

|---|---|

| Ideal | Below 20% |

| Acceptable | 20% – 36% |

| High | Above 36% |

| Caution | Above 43% |

don’t underestimate the importance of financial literacy and education. Understanding basic financial concepts can empower you to make informed decisions, from investing wisely to managing debt effectively. Equipping yourself with knowledge bridges the gap between mere credit scores and true financial health. Explore resources and educational platforms that offer insights into budgeting, investing, and personal finance management, ensuring that you are better prepared to navigate your financial journey.

Establishing a Budget for Long-Term Stability

Crafting a budget is not merely about balancing your immediate expenses; it’s about laying a foundation for sustainable financial health. A practical budget serves as a financial roadmap, guiding you through daily, monthly, and yearly financial choices. When you establish a thorough budget, you create a clear visual portrayal of your income and expenses, enabling you to see where your money is going and where adjustments are needed.

To start, consider breaking down your spending into categories. Here are some common ones to think about:

- Fixed Expenses: Rent or mortgage payments, insurance premiums, and loan payments

- Variable expenses: Groceries, dining out, and entertainment

- Savings and Investments: Emergency funds, retirement accounts, and other investments

- Discretionary Spending: Hobbies, travel, and gifts

Utilizing the 50/30/20 rule can also simplify your budgeting process. This flexible guideline suggests allocating:

| Category | Percentage of Income |

|---|---|

| Needs | 50% |

| Wants | 30% |

| Savings and Debt Repayment | 20% |

Monitoring your budget regularly is essential to ensuring long-term stability. Monthly reviews can help you identify spending patterns and adjust your categories as needed. Consider using budgeting apps or spreadsheets to streamline this process, enabling you to keep real-time insights into your financial health. By fostering a habit of consistent budget assessments, you not only reinforce financial discipline but also allow yourself the flexibility to adapt to changing circumstances, ensuring that your financial wellness is both achievable and sustainable.

Building an Emergency Fund for Peace of mind

Life is unpredictable, and the unexpected can strike at any moment. One of the best ways to prepare for life’s surprises is by establishing a safety net that provides you with financial security. An emergency fund acts as a buffer between you and the unforeseen challenges, whether it’s a medical emergency, a job loss, or urgent home repairs. This fund is not just a financial tool; it’s a source of peace of mind that empowers you to navigate life’s uncertainties without the stress of mounting debts.

Setting up an emergency fund requires dedication and a strategic approach. Here are some essential steps to guide you in building this crucial financial resource:

- Define Your Goal: Start by determining how much you want to save.A common proposal is to have three to six months’ worth of living expenses set aside.

- Choose the Right account: Select a savings account with a good interest rate and easy access to your funds when needed. Online banks frequently enough offer better rates than traditional ones.

- Automate Your Savings: Set up automatic transfers from your checking account to your emergency fund to ensure consistent contributions.

- Review and Adjust: regularly reassess your goals and contributions to ensure that your fund grows in alignment with your financial needs.

To visualize your savings progress, consider using a simple tracking method. Below is a basic table that illustrates potential milestones in your savings journey:

| Month | Amount Saved | Cumulative Total |

|---|---|---|

| 1 | $100 | $100 |

| 2 | $150 | $250 |

| 3 | $200 | $450 |

| 4 | $250 | $700 |

Building an emergency fund is an act of self-care that goes beyond mere financial strategy.It fosters a sense of stability and confidence in your decision-making. With a solid safety net, you can focus on long-term financial goals, knowing that you have the ability to respond when life happens. The journey to financial wellness is not solely about accumulating wealth; it’s also about cultivating the freedom to face uncertainties without worry.

Investing in Financial Education for Empowered Decisions

When it comes to building financial wellness,many individuals focus primarily on credit scores as a measure of their financial health. Though, understanding the broader spectrum of financial education is crucial for making informed and empowered decisions. Financial literacy encompasses various components, each serving to demystify the complexities of money management. By investing time and resources into education, individuals can transform their relationship with finances.

A well-rounded financial education includes distinct areas such as:

- Budgeting: Learning to create and maintain a budget can prevent overspending and foster responsible saving habits.

- Investing: Understanding the different asset classes and market dynamics can lead to making smarter investment choices.

- Debt Management: Knowing how to manage and repay debts effectively can minimize interest payments and future financial burdens.

- Retirement Planning: Preparing for retirement requires understanding various saving instruments and their long-term benefits.

One effective way to gain knowledge in these areas is through structured programs or workshops designed for various skill levels. Community organizations and online platforms frequently enough provide access to resources that can definitely help individuals navigate their financial journeys. For example, local non-profits might offer free seminars on budgeting techniques or investing basics. By participating in such initiatives, individuals can acquire critical skills to enhance their financial decision-making processes.

Moreover, educational resources can serve as tools for fostering collaboration and support among peers. By forming study groups or discussion forums, individuals can engage in meaningful conversations about their financial experiences and share insights. Such collaborative efforts can solidify understanding and encourage accountability. Here’s a simplified table showcasing some valuable educational resources:

| Resource Type | Example | Focus area |

|---|---|---|

| Online Courses | Coursera | Investing Basics |

| Books | “The Total money Makeover” | Debt Management |

| Workshops | Local Community Centers | Budgeting |

| podcasts | The Dave Ramsey Show | Financial Advice |

In a world where financial landscapes can shift rapidly, choosing to expand one’s financial education is not merely beneficial; it is essential. equipped with diverse knowledge, individuals can confront financial challenges with confidence. This proactive approach leads to stimulating healthier discussions about finances in families, workplaces, and communities, fostering a culture of financial empowerment.

In Conclusion

As we wrap up our exploration of financial wellness, it becomes clear that the journey is much more intricate than a mere number on a credit report. While credit scores provide a snapshot of our borrowing habits, they are just one piece of a larger puzzle that encompasses budgeting, saving, investing, and mental well-being. To truly unlock financial wellness, we must embrace a holistic approach—cultivating habits that not only enhance our financial acumen but also nourish our peace of mind.By prioritizing education, fostering healthy financial behaviors, and seeking support when needed, we can break free from the limitations of traditional financial metrics. let us remember that financial wellness is not a destination but a lifelong journey, marked by progress and adaptability. As you take your next steps, consider how each decision aligns with your overall financial health, and strive to create a balance that allows you to thrive, not just survive.financial wellness is about much more than credit scores; it’s about building a life of security, freedom, and empowerment. So, whether you’re setting new goals, reevaluating your current strategies, or simply seeking to understand your financial landscape better, know that every small step you take can lead to a brighter, more financially fulfilled future. The power to unlock your financial wellness lies within your reach—embrace it.