Introduction:

Imagine yoru credit score as a meticulously orchestrated symphony.Each financial element – payments, balances, credit utilization – plays its part, blending to create a harmonious (or dissonant) melody. Now,picture opening and closing credit accounts as introducing new instruments or silencing existing ones.does adding a trumpet boost the overall performance? Does silencing the violin create an unexpected void? Understanding the ripple effects of these actions is paramount to conducting your own credit orchestra with finesse. This article demystifies the seemingly straightforward acts of opening and closing credit accounts, revealing the subtle yet significant impact they have on your credit report and, ultimately, your financial future. Consider this your conductor’s guide to keeping your credit score playing in tune.

Table of Contents

- Unveiling the Credit Account Tapestry: Open Doors and Closing Chapters

- weaving Your Financial Web: Strategic Account management for Credit Health

- Decoding the Credit Score Symphony: How Open and Closed Accounts Conduct the Tune

- Beyond the Score: Gauging the Real World Impact of Your Credit Decisions

- Credit Account Closure: A Calculated Exit Strategy for Long Term Gains

- Q&A

- In Conclusion

Unveiling the Credit Account Tapestry: Open Doors and closing chapters

Imagine your credit report as a complex tapestry, woven with threads representing each credit account you’ve ever opened. Opening a new account adds a vibrant, fresh thread, perhaps strengthening certain areas of the fabric, while closing an account snips away a thread, altering the tapestry’s overall texture and integrity. Understanding how these actions – the opening and closing of credit accounts – impacts your credit score is crucial for maintaining a healthy financial outlook. It’s not as simple as “more is better” or “less is cleaner”; the effect is nuanced and depends heavily on individual circumstances.

Opening a new line of credit can provide a temporary boost in available credit, potentially lowering your credit utilization ratio (the amount of credit you’re using compared to your total available credit). A lower credit utilization is generally viewed favorably by credit scoring models.However, opening too many accounts in a short period can also signal risk to lenders. Furthermore, each submission triggers a “hard inquiry,” which can slightly ding your score. Considerations include:

- The type of account: A credit card will affect your score differently than a mortgage.

- Your existing credit profile: Are you building or rebuilding credit?

- The lender’s terms: Interest rates, fees, and reporting frequency all matter.

Closing a credit account seems straightforward, but it’s where understanding the tapestry analogy becomes vital. Closing an account reduces your overall available credit, which can negatively impact your credit utilization if you carry balances on other cards. Mature accounts with a long history contribute positively to your credit age, a factor that carries significant weight in credit scores. Severing that thread can diminish the apparent longevity of your credit history, potentially causing a dip in your score. However,closing accounts can sometimes be necessary to prevent overspending or manage unused cards with annual fees.

Ultimately, the impact of opening or closing a credit account is a complex calculation. It’s not about blindly adding or subtracting; it’s about strategic weaving and careful snipping. Consider these common credit score actions and their possible effects:

| Action | Possible Positive Effect | Possible negative Effect |

|---|---|---|

| Open a new credit card | Increased available credit; potential rewards programs. | Hard inquiry; tempt to overspend. |

| Close an old credit card | Reduced temptation to spend; simplified finances. | lower available credit; shortened credit history. |

| Open an installment loan | Diversified credit mix; building credit through regular payments. | Adds debt; potential late fees if payments missed. |

Weaving Your Financial Web: Strategic Account Management for Credit Health

Ever feel like your credit report is a mysterious tapestry? Each credit account, opened or closed, is a thread contributing to the overall picture. Understanding how these individual threads affect the complete financial web is crucial for maintaining – or improving – your credit health. Think of it like this: opening an account is like planting a new seed, while closing one is like pruning a branch. Both actions can stimulate growth or lead to unexpected consequences, depending on how you manage them.

So, what actually happens when you take these actions? Opening a new credit account initially lowers your average account age, a factor contributing to your credit score. Though, if used responsibly, it can also increase your credit utilization ratio, as you have more available credit. Closing an account,especially an older one with a positive payment history,can shorten your credit history and increase utilize ratio by decreasing the total available credit across your accounts. It’s a balancing act!

Here’s a quick look at some pros and cons, to guide your decisions:

- Opening a New Credit Account:

- potential benefits:

- Increased available credit

- Chance to earn rewards (if it’s a card)

- Potential risks:

- Hard credit inquiry may temporarily ding your score

- Temptation to overspend

- Closing a Credit Account:

- Potential benefits:

- Reduces the temptation to spend

- Simplifies financial management

- Potential risks:

- Decreases your overall available credit

- May negatively impact your credit utilization ratio

- Utilization Ratio: How much of your available credit you’re using.

- Payment History: on-time payments are paramount for a strong credit score.

- Age of Accounts: Older accounts, handled responsibly, often boost creditworthiness.

- Opening Accounts: Do it strategically. Don’t apply for multiple accounts at once. Consider applying when you have specific needs or goals,like earning rewards or transferring a balance.

- Closing Accounts: Proceed with caution.avoid closing old accounts, even if you’re not using them. If you must close an account, start with the newest one.

- Understanding Impact: regularly monitor your credit report to understand how your actions affect your score.

- Age of the account: Older accounts contribute more to your credit history.

- Credit utilization: Closing accounts can increase your credit utilization ratio.

- Account type: Consider the mix of credit accounts (credit cards, loans, etc.).

- Annual fees: If an account has a high annual fee and you’re not using the benefits, it might be worth closing (weighing the alternatives).

Let’s consider a simple scenario with a table detailing credit utilization impact:

| Before Closing Old Card | After Closing Old Card | |

|---|---|---|

| Available Credit | $10,000 | $5,000 |

| outstanding Balance | $2,000 | $2,000 |

| Credit Utilization | 20% | 40% |

In this example, closing the account doubled the credit utilization, potentially harming the score. Careful planning is indeed essential for weaving a solid financial web!

Decoding the Credit score Symphony: How Open and Closed accounts Conduct the Tune

Think of your credit score as a symphony orchestra. Each credit account, whether open or closed, plays a vital role in the overall performance. Open accounts, like the violins and cellos, are actively contributing to the melody, showcasing your current ability to manage debt responsibly. Closed accounts, the ghostly echoes of trumpets and horns, represent past performances, either harmonious or discordant, still resonating within the larger composition.

Open accounts are often categorized as either installment or revolving credit. Installment accounts, such as mortgages or auto loans, have fixed payments and a set end date, demonstrating your ability to commit to a long-term financial obligation. Revolving accounts, like credit cards, offer more flexibility but demand careful management.Keeping balances low and making timely payments on these active accounts paints a vibrant,positive picture for lenders. Here are some key aspects of open accounts:

Closed accounts,while no longer actively contributing,still hold valuable information.A history of responsible repayment on closed accounts is viewed favorably, indicating a pattern of good financial behavior. Though, closed accounts can also have a negative impact if they reflect past delinquencies. It’s a detailed ledger of your past financial conduct. below you will find an example of how to properly register good behavior on a closed account:

| Account Type | Status | Impact |

|---|---|---|

| Credit Card | Closed (Paid in Full) | Positive |

| Student Loan | Closed (Satisfied) | Typically Neutral/Positive |

| Auto Loan | Closed (Repossessed) | Negative |

Beyond the Score: Gauging the Real World Impact of Your Credit Decisions

Think of your credit accounts as tools in your financial toolbox. Each one, whether it’s a credit card, a loan, or a line of credit, has a specific purpose and can either build or weaken your overall financial structure. Opening a new account widens your access to credit, potentially improving your credit utilization ratio (the amount of credit you’re using versus your total available credit), especially if you’re not maxing out existing cards. Though,too many new accounts in a short period can signal higher risk to lenders,lowering your score. Conversely,closing an account might seem like a good way to simplify your finances,but it can reduce your available credit,increase your credit utilization,and potentially harm your credit score,especially if it’s an older account with a positive payment history.

The age of your credit accounts plays a crucial role in your creditworthiness. Older accounts with consistent, on-time payments demonstrate responsible credit management over time. Closing an older account shrinks your credit history, potentially lowering your score. Therefore, before closing any account, especially an old one, consider the long-term impact. It’s not just about the immediate convenience; it’s about the potential ripple effect on your future borrowing power.Ask yourself: Does the convenience of closing this account outweigh the potential negative impact on my credit history and score?

So, how do you navigate these decisions? Here’s a quick guide:

Let’s illustrate the potential consequences with a quick example:

| Scenario | Action | Possible Credit Score Impact |

|---|---|---|

| High Credit Utilization | Closing an old credit card with a high limit. | Decrease in score (utilization increases). |

| Building Credit | Opening a secured credit card and making on-time payments. | Increase in score (demonstrates responsibility). |

| Numerous Inquiries | Applying for 5 credit cards within 2 months. | Potential decrease (signals higher risk). |

Credit Account Closure: A Calculated Exit Strategy for Long Term Gains

Navigating the world of credit scores can feel like traversing a financial labyrinth. Each credit account you open or close acts as a decision point,influencing your overall credit health. Understanding the ramifications of these actions is crucial for building and maintaining a strong credit profile. Are you optimizing your credit strategy, or are you inadvertently hindering your progress?

A common misconception is that simply having more open credit accounts is always better. While a higher overall credit limit can positively impact your credit utilization ratio (the amount of credit you’re using compared to your total available credit), opening too many accounts in a short period can raise red flags for lenders. They might perceive you as a higher risk borrower, potentially lowering your credit score.

Conversely, closing accounts, especially older ones, can also have unintended consequences. The age of your credit history is a significant factor in credit scoring models. Closing an older account reduces the average age of your credit history, which might negatively impact your credit score. Similarly, closing accounts with available credit reduces your overall credit limit, potentially increasing your credit utilization ratio if you carry balances on other cards.

Before making decisions about closing credit accounts,consider the following:

| Account State | Impact |

|---|---|

| Opening multiple accounts | Potential score decrease |

| Closing older accounts | Potential score decrease |

Q&A

credit Account Conundrums: A Q&A for Clarity

So, you’re thinking about opening a credit card for that sweet rewards program, or maybe closing one you haven’t used in eons? Before you swipe or snip, let’s unravel the mystery surrounding how these actions actually affect your credit score. Read on to become a credit account whisperer!

Q: Okay, hit me with the basics.Opening a new credit account seems like a good thing – more available credit, right? But is it really?

A: Ah, the Siren song of shiny new credit! Opening an account is a bit of a double-edged sword.On the one hand, adding to your overall available credit can lower your credit utilization ratio (we’ll get to that delicious detail later!), which is generally a boon.However, it also triggers a hard inquiry on your credit report, which can ding your score slightly. Plus, a new account lowers your average age of accounts, another factor that can impact your score, especially if your existing accounts are relatively young. Think of it as planting a sapling in your financial forest – it takes time to mature and add to the overall landscape.

Q: You mentioned credit utilization ratio. What in the world is that, and why does it sound like something Marty mcfly should be tackling?

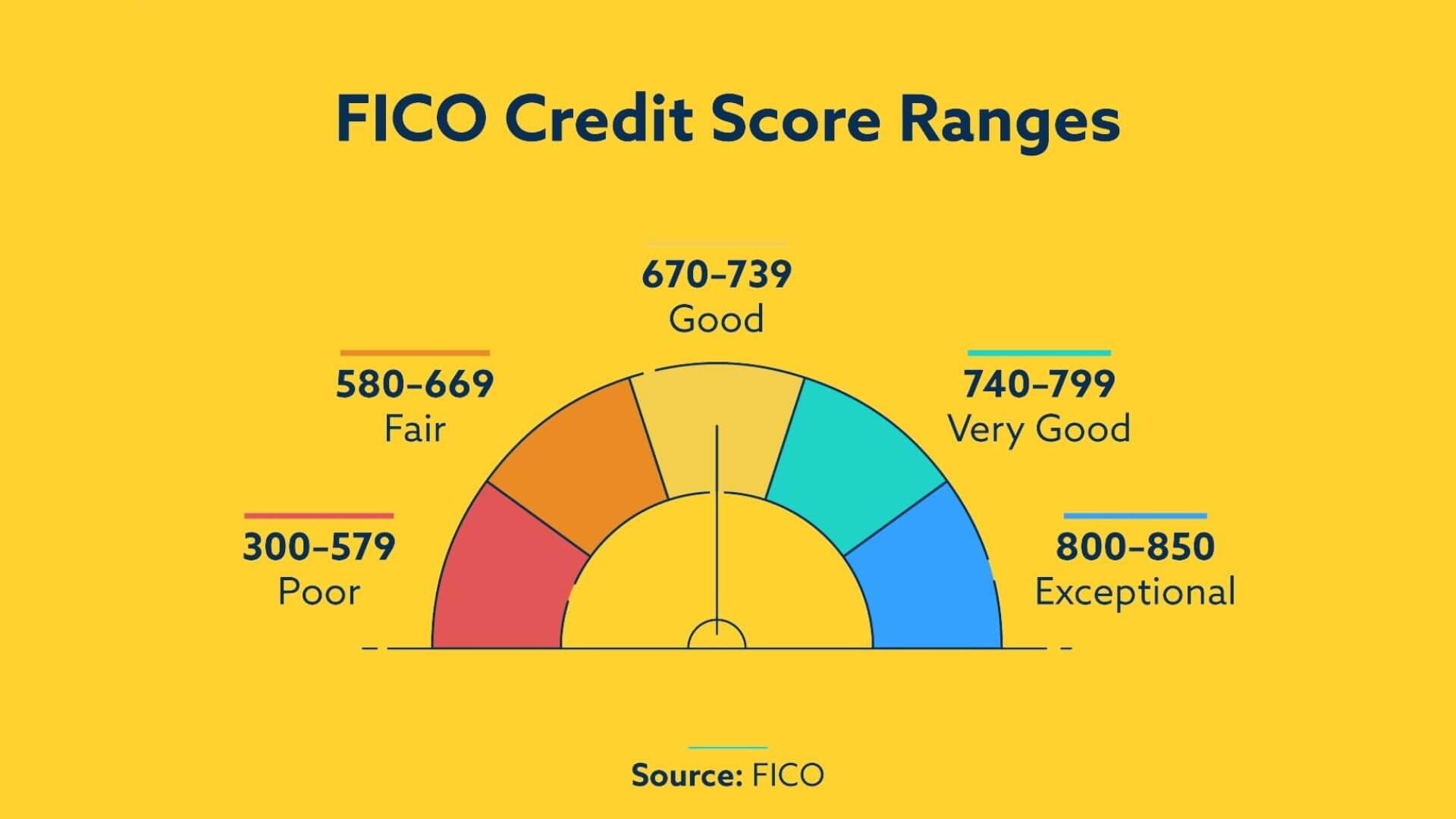

A: Fear not, no DeLorean needed! Credit utilization is simply the amount of credit you’re using compared to your total available credit. Think of it like this: imagine you have a credit card with a $10,000 limit. If you’re typically carrying a $2,000 balance, your credit utilization is 20%. Experts generally recommend keeping it below 30%,and even lower is better! This is a significant factor in your credit score,so keeping an eye on it is indeed crucial.High utilization screams “risky borrower!” to lenders.

Q: Alright, Got it. Low utilization = good. Higher utilization = uh oh. But what about store credit cards? I see them everywhere! Should I sign up?

A: Store credit cards can be tempting, with their exclusive discounts and perks. However, be cautious.While they can help build credit,they often come with higher interest rates and lower credit limits. This can inadvertently lead to higher credit utilization if you’re not careful.And remember, the benefits often only apply at that particular store. Weigh the pros (potential discounts) against the cons (higher interest, lower limits) carefully before taking the plunge.

Q: On the flip side, I have an ancient credit card I barely use. It feels like dead weight. Should I just chop it up and be done with it?

A: Whoa there, Captain Cutter! Closing an old credit card can be a tricky maneuver. While the satisfaction of decluttering your finances is tempting, think about the impact.Closing that old account reduces your total available credit, which can increase your credit utilization if you carry balances on other cards. furthermore, the age of an older, closed account is still factored into your average age of accounts for a period (typically 10 years!), so closing it prematurely might harm your credit score more than help. Think of it as carefully dismantling a stable part of your financial foundation, not just throwing it in the trash.Q: So, if I shouldn’t close it completely, can I just leave that old card at a $0 balance and let it collect dust?

A: leaving it dormant can be a viable option, but be mindful of inactivity fees! Some credit card companies will charge fees if an account isn’t used within a certain timeframe. Also, periodically check your account statements to make sure there’s no fraudulent activity. A small purchase every few months, followed by immediate payment, can keep the account active and prevent potential issues.

Q: This is all starting to make my head spin! Any final words of wisdom for navigating this credit account minefield?

A: Patience is key, and knowledge is power! Be mindful of your credit utilization, understand the impact of opening and closing accounts, and regularly monitor your credit report for errors. Don’t be afraid to consult with a financial advisor if you’re feeling overwhelmed. Remember, building good credit is a marathon, not a sprint. And a well-maintained credit report is your passport to a brighter financial future!

In Conclusion

So, there you have it. Understanding the impact of opening and closing credit accounts is like understanding the ebb and flow of a financial tide.It’s about recognizing that every action, even one seemingly small, creates ripples in your credit score’s sea. Now armed with this knowledge,you can confidently navigate the waves of credit,making informed decisions that chart a course towards smoother financial waters. Remember, building a healthy credit profile is a marathon, not a sprint. Keep learning, stay proactive, and watch your financial horizons expand.