Imagine your credit history as a digital yearbook, each entry a snapshot of your financial life. Late payments scowl from the page, while on-time payments beam. But what if you could magically erase a less-than-stellar memory? Enter the pay-for-delete agreement, a whispered promise of cleansing your record in exchange for settling a debt. Tempting,isn’t it? But is it too good to be true? This article delves into the murky waters of pay-for-delete agreements,separating fact from fiction and helping you decide if this potential swift fix is a viable solution or a recipe for deeper financial woe. We’ll examine the benefits, the risks, and ultimately, whether these agreements are truly worth the price of admission.

Table of Contents

- Navigating the Murky Waters of Pay for Delete

- Credit Report Riddles Unveiled

- Negotiating Your Debt Deletion Deal

- assessing the Risks and Rewards

- Making a Strategic Decision Regarding Pay for Delete Agreements

- Q&A

- Final Thoughts

Navigating the Murky Waters of Pay for Delete

Imagine wading through a digital swamp, your online reputation clinging to you like mud. You stumble upon negative reviews, unflattering articles, or perhaps worse – deeply personal information you wish was buried forever. Then, a life raft appears: the promise of “pay-for-delete.” Tempting, isn’t it? These agreements, essentially a transaction where you pay a website or platform to remove damaging content, operate in the gray areas of the internet. But before you reach for your wallet, understanding the murky depths of these arrangements is crucial.Are you trading short-term relief for long-term risk?

The allure is obvious. Who wouldn’t want to erase evidence of past mistakes, perceived injustices, or simply outdated information? However, the ethical, legal, and practical implications are considerable.Consider these potential pitfalls:

- Ethical Quagmire: Is it right to essentially “bury” the truth, even if it’s unflattering? Does it stifle legitimate criticism or accountability?

- Legality Labyrinth: Depending on the content and jurisdiction, these agreements could be legally vulnerable, especially if the information is deemed factual and in the public interest.

- Security Seas: Paying questionable websites could open you up to further exploitation or even blackmail.

Beyond the ethics and legality, the effectiveness of pay-for-delete agreements is often questionable. Even if the content is removed from one site, it might already be cached by search engines, syndicated to other platforms, or simply living on in screenshots and shared links. Think of it like trying to drain a swamp with a leaky bucket. You might remove some water, but the problem remains. Moreover, paying for removal can sometimes backfire, drawing even more attention to the original negative content. It becomes a signal: “This must be juicy!”

So, is a pay-for-delete agreement ever “worth it”? The answer is almost always a resounding “maybe,” heavily caveated.It’s a high-stakes gamble. Before contemplating this path,exhaust all other avenues. Consider legal options, engage in reputation management strategies (like creating positive content to overshadow the negative), and, most importantly, learn from the experiences that led to the damaging content in the first place.perhaps the best defense against the swamp is to avoid wading into it completely.

| Consideration | Risk Level |

|---|---|

| Ethical Concerns | High |

| Legal Implications | Medium |

| Financial Cost | Variable |

| Reputation Risk | Potentially Higher |

Credit Report Riddles Unveiled

Ever heard whispers of a secret deal, a bargain struck in the shadows of credit blemishes? That’s frequently enough the mystique surrounding “pay-for-delete” agreements.But are these whispered promises of credit redemption genuine paths to a squeaky-clean report, or simply fool’s gold glittering with false hope? The truth, as always, lies somewhere in the murky middle. These agreements, where you offer to pay off a debt in exchange for the creditor removing the negative listing from your credit report, can seem like a lifeline.Before diving in headfirst, let’s dissect the pros, cons, and everything in between.

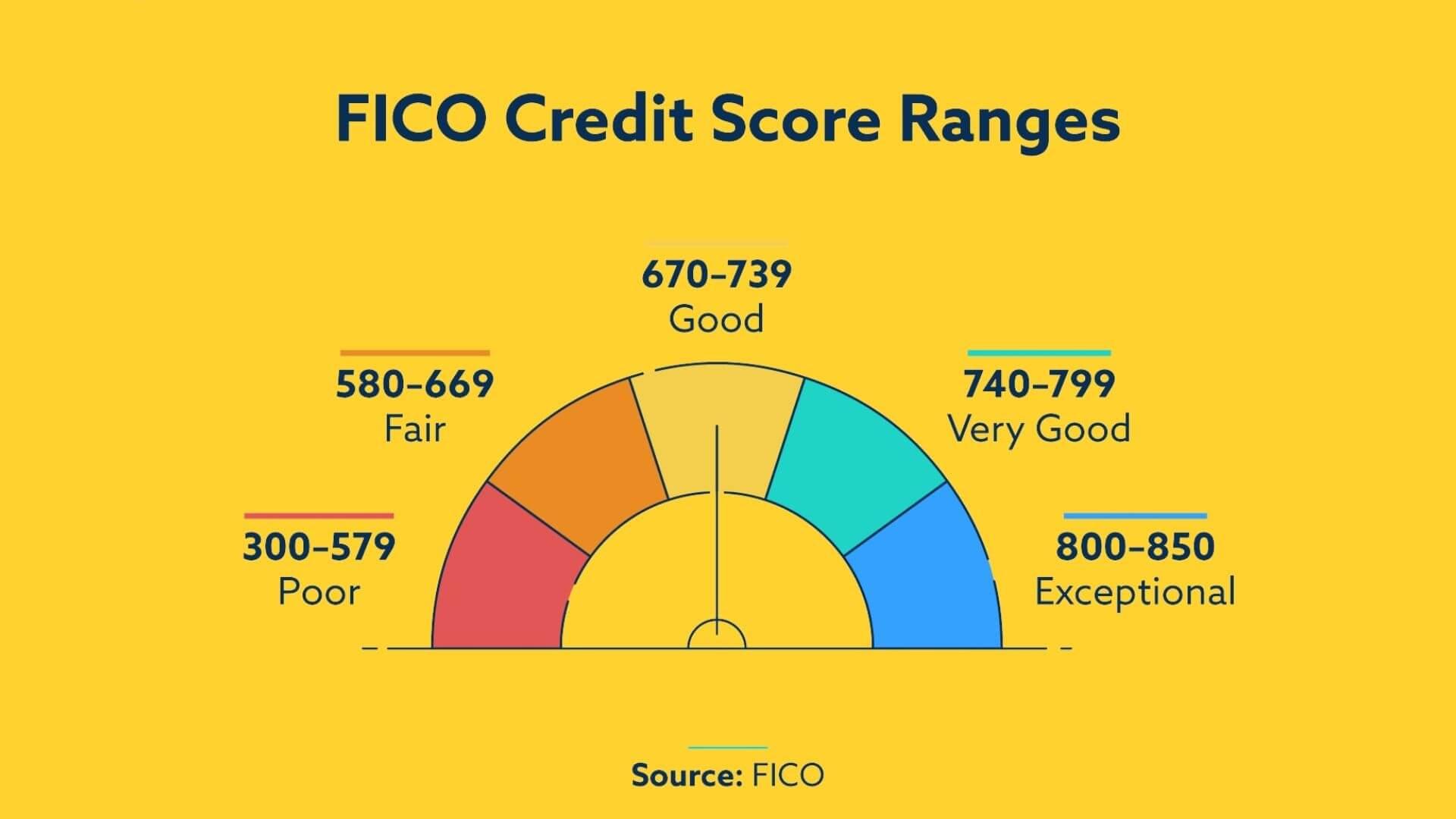

The allure is obvious: a swift removal of a derogatory mark could potentially boost your credit score, opening doors to better interest rates, loan approvals, and even rental opportunities. Though, a crucial caveat exists. There’s no guarantee a creditor will agree to a pay-for-delete arrangement. In fact, many creditors have policies against it, as it can be seen as a misrepresentation of your credit history. Even if thay verbally agree, getting it in writing is paramount. Without written proof, you’re essentially handing over your money with nothing but a pinky promise to rely on. Remember, your credit report is a story, and pay-for-delete agreements aim to rewrite a chapter, which is a practice creditors frequently enough frown upon.

Even with a written agreement,the waters remain choppy. Here’s why:

- Breach of Contract: Creditors can, and sometimes do, renege on the agreement after you’ve paid.Pursuing legal action can be costly and time-consuming.

- Credit Bureau Scrutiny: Credit bureaus actively monitor for inconsistencies and can flag deleted entries that appear suspicious.

- No Guarantee of Score Improvement: Even with the deletion, your score might not improve as substantially as you hoped. Other negative marks, age of your credit history, and overall credit utilization all play a role.

So, when does exploring a pay-for-delete agreement make sense? Consider these situations carefully and weigh them against the risks:

| Scenario | Potential Benefit | Caveat |

|---|---|---|

| Erroneous Reporting | Clear up factual inaccuracies | Focus on disputing first |

| Old Collection Account | Improve credit picture, post statute of limitations | Check the expiration date first |

| High-Cost Loan Refinance | Obtain approval for lower interest rates | Ensure the savings outweigh the risk |

Negotiating Your Debt Deletion Deal

Crafting Your Offer: Sweetening the Deal

So, you’re thinking of dangling the “pay-for-delete” carrot? Smart move. But simply offering to pay the debt isn’t always enough. Lenders and collection agencies are frequently enough wary, knowing it’s not standard practice. You need to make your offer compelling. Consider offering a lump-sum payment that’s a significant portion of the debt. Remember, they’re giving up the potential for collecting the full amount, so sweeten the pot!

Think about emphasizing the benefits they will receive. Are you consistently paying other bills on time? Highlight your improved financial responsibility. Showing a willingness to commit to future business with them can add significant value to the deal, and maybe sway them to accept your offer.Also, offer a clear and concise payment plan with a firm timeline. If you can, start by offering to pay a larger percentage of the debt upfront.

Here are the types of information you can supply:

- Lump sum payment: Highlight the immediate benefit of receiving a substantial amount of money without further collection efforts.

- Improved financial responsibility: Show a consistently paying records of others financial transactions.

- Future business with you: Mention other services/products they provide that you are interested in using after the agreement is fulfilled.

If your initial offer is rejected, don’t give up immediately. Negotiating debt is a process and requires patience and adaptability to be successful. Be willing to adjust your terms. Such as, you could increase the payment amount slightly or accelerate the payment schedule. It’s essential to stay professional and respectful throughout the negotiation, even if you encounter resistance. Remember, successful debt deletion deals frequently enough involve persistence, compromise, and a little bit of creative thinking.

| Offer Element | Exmaple |

| Initial Offer % | 60% |

| Revised Offer % | 75% |

| Payment Timeline | 3 Months |

Assessing the Risks and Rewards

Imagine you’re a detective dusting for fingerprints, trying to erase a past mistake. A pay-for-delete agreement tantalizes with the promise of a clean slate – that mark on your credit report, seemingly permanent, vanishing for a fee. But before you hand over your hard-earned cash, consider this: is the illusion of erasure worth the potential pitfalls lurking beneath the surface?

The allure is obvious. A blemish-free credit report can unlock doors to lower interest rates,better loan terms,and even employment opportunities. However, the reality often involves navigating murky waters.Think about these potential benefits:

- Improved Credit Score: Possibly a temporary boost.

- Reduced Stress: Emotional relief from seeing the negative mark gone.

- Negotiating Power: Might make future financial discussions easier.

But remember, creditors agreeing to delete the information are not obligated to do so, and even if they do, the impact might be less significant than you anticipate. Are you betting on a winning hand with a stacked deck?

Now, let’s flip the coin. While the prospect of deletion is tempting, the risks are equally real. The agreement itself may be legally questionable, and even if it’s valid, the creditor could simply re-report the information later. Plus, paying to delete a debt could be interpreted as an acknowledgement of guilt, potentially impacting your legal standing in any ongoing disputes.Here’s a summary of possible risks:

| Risk | Severity |

|---|---|

| Creditor Reneging | high |

| Legal Ramifications | Medium |

| Temporary Fix | Medium |

| Financial Cost | Low |

Ultimately,the decision hinges on a thorough evaluation of your individual circumstances. Are you dealing with a genuinely inaccurate debt? Could challenging it through standard dispute channels be a more effective and sustainable solution? Or,are you simply seeking a shortcut to a better credit score,potentially opening yourself up to unforeseen consequences? Understanding the intricacies of credit reporting and debt collection practices is paramount before engaging in any payment-for-deletion agreement. The potential reward must genuinely outweigh the significant risks involved.

Making a Strategic Decision Regarding Pay for Delete Agreements

Navigating the reputation management landscape often feels like traversing a minefield. Occasionally, you stumble upon negative online content that threatens to tarnish your brand. This is where the allure of Pay-for-Delete agreements surfaces,seemingly offering a clean slate at a price. Before you jump at the chance to erase unfavorable reviews or articles, understand that these agreements are not a simple transaction; they’re a strategic crossroads demanding careful consideration. Are you merely sweeping dirt under the rug,or are you genuinely addressing the underlying issues fueling the negative content?

The core question revolves around value versus risk. While the immediate gratification of disappearing negative content is tempting, it’s crucial to weigh the potential downsides. Consider these points:

- Ethical Implications: is paying for removal morally justifiable, especially if the content is factual?

- Legal Repercussions: Are you potentially opening yourself up to legal issues if the content is removed without justification?

- Discovery: What if the deletion comes to light? The resulting backlash could be far more damaging than the original negative content.

- Sustainability: Does removing content truly address the root cause, or will similar issues arise again in the future?

To further illustrate the complexities, let’s consider a few scenarios:

| Scenario | Potential Benefit | Potential risk |

|---|---|---|

| Removing a factually incorrect review. | Immediate image repair. | Accusations of censorship if discovered. |

| Deleting libelous accusations. | Legal protection and reputational safeguard. | Potential legal challenges from the content originator. |

| Suppressing negative but truthful customer feedback. | Short-term sales boost. | Loss of customer trust and long-term brand damage. |

Ultimately, the decision hinges on a meticulous evaluation of your specific circumstances. A robust reputation management strategy should prioritize proactive measures, such as exceptional customer service and transparent communication. Pay-for-Delete Agreements should be reserved for situations where all other avenues have been tired, and where the content in question is demonstrably false, misleading, or legally actionable. Before signing on the dotted line, seek expert advice from legal counsel and reputation management professionals to ensure you understand the full ramifications of this strategic decision.

Q&A

Understanding Pay-for-Delete agreements: Are They Worth It? – Your Burning Questions answered

So, you’ve stumbled upon the shadowy world of “Pay-for-Delete” agreements and are wondering if they’re your ticket to credit score salvation? We’re diving into the depths to illuminate the facts and help you decide if this strategy is right for you.

Q: Okay,spill the tea. What exactly is a Pay-for-Delete agreement? Is it some kind of Jedi mind trick on my credit report?

A: Think of it less as a Jedi mind trick and more as a negotiation. A Pay-for-Delete agreement is exactly what it sounds like: you agree to pay off a debt to a creditor or collections agency in exchange for them deleting the negative entry from your credit report. In theory, this removes the blemish and boosts your score.

Q: Sounds amazing! Where do I sign? Hold on… is it actually legal? Feels a little… sketchy.

A: It’s certainly not illegal, but it’s legitimacy is a bit like a mirage in the desert. While perfectly acceptable in principle, these agreements aren’t universally embraced. Many creditors are hesitant to agree, preferring to simply mark the debt as “Paid” rather than erase its history.

Q: So, if they aren’t jumping at the chance, why even bother? Does it actually work?

A: The effectiveness is a gamble, a roll of the dice. If you can secure a pay-for-Delete agreement and they follow through, it can positively impact your credit score. Think of it as removing a splinter that was slowing down your healing. However,creditors are increasingly aware of their obligations to report accurate information,which often means reporting the fact a debt existed,even if it was paid.

Q: Alright, you’ve convinced me to try. How do I even approach a creditor about this? Do I just slide into their DMs with a proposition?

A: DMs are probably not the way. Communication is key, but subtlety is not your friend. Be upfront (but polite!). Contact the creditor or collection agency in writing, outlining your offer to pay the debt in full in exchange for complete removal from your credit report. Keep meticulous records of all communication. Think of it like building a case in court, you need evidence.

Q: What if they say “hard pass”? Am I doomed to credit purgatory?

A: Not at all! rejection is just part of the game. If they decline, explore other options.Consider a payment plan to show good faith, or dispute the debt if you believe it’s inaccurate or invalid. There are other paths to credit repair. Think of it like climbing a mountain – there are multiple trails to the summit.

Q: Okay, last question. Is pursuing a Pay-for-Delete agreement always the best strategy?

A: Not necessarily. it’s a calculated risk, not a magic bullet. If the debt is very old or close to statutory limits, letting it age may be a better option. Honestly assess your situation, weigh the potential benefits against the risks, and consider consulting with a credit counseling professional. Remember, building a healthy credit score is a marathon, not a sprint. A Pay-for-Delete might be a helpful tool, but it’s just one piece of the puzzle.

Final Thoughts

So,you’ve journeyed through the winding roads of pay-for-delete agreements. You’ve seen the potential shimmering mirage of a quick score-boost, and felt the gritty reality of the possible pitfalls hiding beneath the surface. Ultimately, whether or not these arrangements are “worth it” depends entirely on your unique financial landscape and risk tolerance. Think of it as choosing a map for your credit journey. Do you opt for the shortcut, knowing there might be detours and dead ends? Or do you stick to the well-worn path, a longer, more purposeful route to credit health?

Before signing on the dotted line, arm yourself with knowledge, leverage the resources we’ve mentioned, and don’t be afraid to seek professional guidance. remember, your credit score is more than just a number; it’s a gateway to opportunities, a reflection of your fiscal responsibility. So, tread carefully, choose wisely, and may your credit score always be on the rise.