Imagine your buisness as a tiny seed, brimming with potential to blossom into a towering oak. Sunlight and water alone aren’t enough to nurture its growth; it also needs healthy soil. In the entrepreneurial ecosystem, that fertile ground is your business credit. A solid business credit profile isn’t just a scorecard – it’s the key to unlocking opportunities, securing vital funding, and ultimately, building a legacy that lasts. This guide illuminates the path towards cultivating robust business credit, offering entrepreneurs a roadmap to navigate the complexities and reap the rewards. Let’s sow the seeds of success, one credit point at a time.

Table of Contents

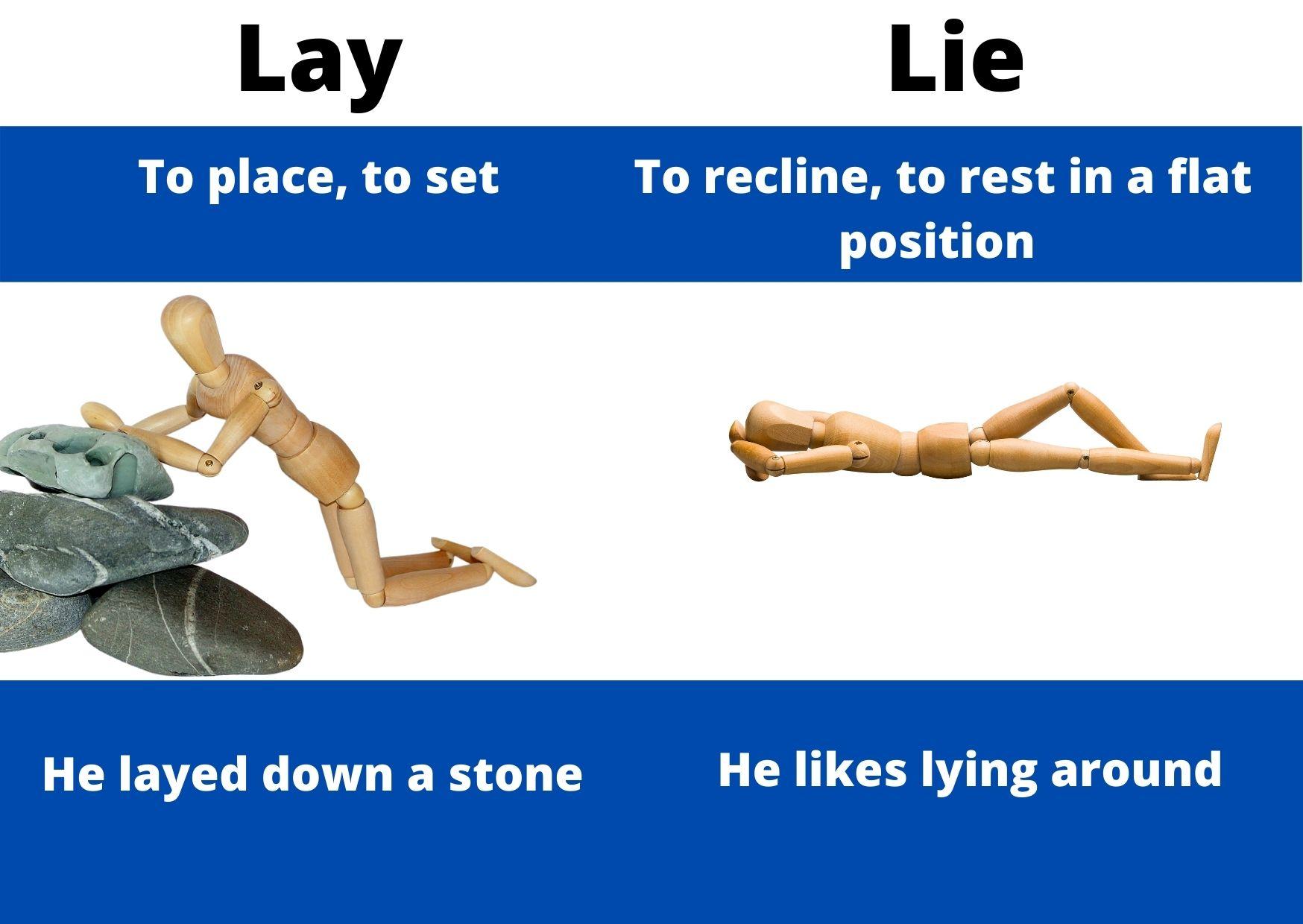

- Laying the foundation Establish a Separate Business Identity

- Beyond Personal Scores Crafting a Credit profile for Your Enterprise

- Trade Lines and Beyond Leveraging Vendor Relationships for Credit Growth

- Strategic Credit Utilization Maximizing Your Score with Smart Practices

- Monitoring and Maintenance Ensuring LongTerm Creditworthiness

- Q&A

- Wrapping Up

Laying the Foundation Establish a Separate Business Identity

Before you even think about applying for business credit, you need to clearly define your business as separate and distinct from your personal finances. Think of it as building a wall – you wont it impenetrable to protect your personal credit score. This foundation is built on meticulous details and consistent adherence to established best practices. Failing to do so is like building a house on sand!

here’s what that foundation looks like in practice. It’s more than just filing paperwork; it’s about creating a persona for your business in the eyes of lenders and creditors:

- Legal Formation: Officially register your business as an LLC, S-Corp, or C-Corp.

- EIN: Obtain an Employer Identification Number (EIN) from the IRS. This is your business’s social security number.

- Registered Agent: appoint a registered agent to receive legal and official documents on behalf of your business.

- Business Bank Account: Open a dedicated business bank account. DO NOT mix personal and business funds.

- Business Address & phone: Secure a physical business address (a P.O.Box might raise red flags) and a dedicated business phone line.

- Professional Email: Use a professional email address (e.g., yourname@yourbusiness.com), not a personal one.

Why is all this so critically important? Lenders and credit bureaus need to verify that your business is a legitimate entity before they’ll extend credit. They’ll be looking for consistency across all platforms. Imagine presenting the following data to a potential lender:

| Details Point | Potential Red Flag |

|---|---|

| Business Name | Uses owner’s nickname instead of registered LLC name |

| Business Address | Redirects to a personal home address |

| Phone Number | Connected to a personal cell phone |

These inconsistencies immediately raise questions about the legitimacy and professionalism of your business. Setting the stage for business credit starts with removing any doubts.It’s a process of verification and separation, and a testament to your commitment as a serious entrepreneur. This critical initial step is the foundation for a strong business credit profile and is the first building block to long-term success.

beyond Personal Scores Crafting a Credit Profile for Your Enterprise

So, you’ve poured your heart and soul (and likely a good chunk of your personal savings) into launching your business.You’re hustling, growing, and dreaming big. But have you considered a crucial aspect that often gets overlooked: building credit for your business, separate and apart from your own?

Think of your business credit profile as its financial DNA. It’s a unique identifier that tells lenders, suppliers, and even potential partners how trustworthy your company is when it comes to managing debt and fulfilling financial obligations. It’s about establishing credibility and unlocking opportunities that simply aren’t available when relying solely on your personal credit score. it’s not just about loans; it’s about building a solid foundation for enduring growth.

But where do you even begin? Here are a few key ingredients to crafting a compelling business credit profile:

- Register Your Business Properly: Ensure you have the correct legal structure (e.g., LLC, S Corp) and obtain an Employer Identification Number (EIN) from the IRS. This is the foundation upon which your business credit will be built.

- Establish a Business Bank Account: Keep your personal and business finances separate.A dedicated business bank account is a sign of professionalism and facilitates financial tracking.

- Obtain a D-U-N-S Number: This unique nine-digit identifier is assigned by Dun & Bradstreet (D&B) and is widely recognized as a business’s Social security number. It allows creditors to track your company’s payment history.

- Net-30 Accounts: Open accounts with suppliers and vendors that report to business credit bureaus. Pay your invoices on time (within 30 days) to demonstrate responsible credit management.

Consider the difference a good business credit rating can make. Imagine these scenarios:

| Scenario | Personal Credit Only | Strong Business Credit |

|---|---|---|

| Loan Approval | Higher interest rates, personal guarantees required. | Lower interest rates, favorable terms, no personal guarantee needed |

| Supplier Relationships | Cash up front, limited credit lines. | Net-30 terms, larger credit lines based on history. |

| Insurance Premiums | Higher premiums due to perceived risk. | Lower premiums reflecting financial stability. |

Trade Lines and Beyond Leveraging Vendor Relationships for Credit Growth

Beyond securing a loan from a traditional financial institution,your existing vendor relationships can be a goldmine for building business credit. Think of your suppliers as potential credit partners. Establishing net-30 accounts, where you pay invoices within 30 days, with reputable vendors who report to business credit bureaus is a fantastic way to establish a positive payment history. Just like personal credit cards, consistent on-time payments are credit score building blocks. But remember, not all vendors report, so due diligence is key! Inquire about their reporting practices upfront to ensure your efforts contribute to your business credit profile.

Strategic selection is crucial. Prioritize suppliers you already have a strong relationship with and who offer services or supplies essential to your operations. This ensures you’re not taking on unnecessary expenses solely for the sake of building credit. Negotiate for favorable terms like longer payment windows or early payment discounts, which can improve cash flow management and build even stronger vendor relationships.

Consider these key strategies for leveraging vendor relationships:

- Research potential vendors: Identify which report payment information to credit bureaus.

- Negotiate payment terms: Aim for net-30 or longer payment windows.

- Make timely payments: Consistent on-time payments are vital.

- Maintain open interaction: Keep your vendors informed of any potential payment delays.

Think of vendor relationships as a stepping stone. These relationships can help build a solid foundation, allowing your business to grow. As your credit profile strengthens, you become eligible for more favorable credit terms with other lenders and can unlock opportunities for expansion and investment.

| Vendor Type | Credit Agency | Payment Behavior |

|---|---|---|

| Office Supplies | Experian Business | Excellent |

| Marketing Agency | Equifax Small Business | Good |

| Web Hosting | Dun & Bradstreet | Fair |

Strategic Credit Utilization Maximizing Your Score with Smart Practices

Entrepreneurs, building a solid business credit profile can feel like navigating a maze. But understanding how strategic credit utilization impacts your score is key to unlocking financial opportunities. It’s not just about *having* credit; it’s about *how* you use it. Think of your business credit report as a report card for lenders, showing your ability to manage debt responsibly. A high score opens doors to larger loans, better interest rates, and favorable terms with suppliers. Ignoring this crucial aspect can severely limit your business’s growth potential.

One of the meaningful factors that impacts your business credit score, especially with agencies like Experian and Dun & Bradstreet (D&B), revolves around your credit utilization ratio. This is the amount of credit you’re using compared to your available credit. Aim for a utilization rate below 30% on each credit line to signal responsible credit management. Exceeding this threshold can negatively impact your score even if you consistently make timely payments. Consider the following tips to master usage:

- Monitor your balances: Regularly check your credit card and line of credit balances.

- Strategically pay down debt: focus on paying down balances before the reporting date to keep your utilization low.

- Request credit line increases: A higher credit limit can automatically lower your utilization ratio, assuming your spending remains constant. But avoid the temptation to overspend!

Beyond consistent on-time payments,diversity in your credit mix also plays a role. Lenders appreciate seeing you can handle different types of credit responsibly. Here’s a simplified illustration:

| Credit Type | Example | Impact |

|---|---|---|

| Trade Credit | Supplier Net-30 terms | Shows consistent payment to vendors. |

| Credit Card | Business credit card | Demonstrates versatile credit management. |

| Line of Credit | Working Capital Loan | Displays the ability to manage larger debts. |

Monitoring and Maintenance Ensuring LongTerm Creditworthiness

Think of your business credit profile as a delicate ecosystem, constantly evolving and requiring careful nurturing. Building it is only half the battle; protecting and strengthening it requires vigilant monitoring and proactive maintenance.Neglecting this vital aspect can lead to unforeseen damage, eroding the creditworthiness you’ve worked so hard to establish. The key is to develop a system for tracking your credit health and addressing any potential issues promptly.

So, how do you ensure your business credit remains in tip-top shape? Regularly reviewing your credit reports from all major business credit bureaus is paramount. Look for inaccuracies, outdated information, or signs of potential fraud. Implement internal controls to ensure timely invoice payments and accurate financial reporting. Don’t be afraid to challenge errors on your credit reports; a single discrepancy can negatively impact your rating. Further, consider these maintenance steps:

- Pay attention to your Days Beyond Terms (DBT): Consistently paying vendors late will trigger negative reporting.

- Maintain updated contact information: Ensure your business name, address, and phone number are accurate across all platforms.

- Review payment history against your vendors: Stay on top of potential discrepancies to quickly dispute them.

- Keep tabs on industry insights. Adapt proactively to emerging trends and standards concerning ratings.

Let’s look at how these maintenance steps can result in a positive outcome with an example:

| Action | Before Maintenance | After Maintenance |

| DBT with Supplier A | 60 Days | 15 Days |

| Address Accuracy | Previous Location | Current HQ |

| Credit Score Impact | Moderate Negative Impact | Positive/Neutral Impact |

Q&A

building Business Credit: A Guide for Entrepreneurs – Q&A

So, you’re an entrepreneur, a go-getter, a builder of dreams. But are you building business credit? It’s not just for big corporations anymore, and you might be surprised how crucial it is. We sat down to address some burning questions you problably have:

Q: Okay, “business credit”… sounds official.Explain it to me like I’m talking to my dog (who happens to be surprisingly business-savvy).

A: Imagine “business credit” as a doggy treat jar, but for your company! When you’re a good pup (pay your bills on time, build relationships), the jar fills up. A full treat jar means you can get better loans, negotiate sweeter deals with suppliers, and even land that dream bone-shaped office building! It’s separate from your personal credit, so even if you had a momentary lapse of treat-earning judgment in the past, your business can still earn its own rewards.Q: Right, got it. Treats! But how do I even start building this treat-filled jar? It’s not like I can just apply for a business credit card with my puppy-dog eyes,right?

A: While puppy-dog eyes are a powerful tool,they sadly won’t work here. First, make sure your business is properly registered and has a unique Employer Identification Number (EIN).Think of it as your business’s official name tag. Then, start small: open a business bank account, get a business credit card, and establish vendor relationships. Trade references are golden! pay your invoices on time (or even early!) to show those credit bureaus you’re a responsible treat-earner.

Q: Vendor relationships? Trade references? Sounds a bit like…networking.Will I have to schmooze?

A: Think of it less as schmoozing and more as building valuable partnerships. When you pay your suppliers on time, they’re more likely to report your positive payment history to credit bureaus. It’s a win-win! They get paid reliably, and you build your business credit. So, be a reliable partner, communicate clearly, and treat your vendors with respect. Good business is built on good relationships, and that includes your credit!

Q: alright, partnerships. Got it. What are some common mistakes entrepreneurs make when trying to build business credit? I want to avoid those like the plague (or a skunk!).

A: The biggest blunder? Mixing personal and business finances. Keep them entirely separate! Using your personal credit card for business expenses, or having all your business revenue flow through your personal account, is a big no-no. It makes it tough to track business performance and prevents you from building your business’s own credit profile. Also, neglecting to monitor your business credit reports can hide errors that could be damaging. Regularly check your reports – knowledge is power (and good credit!).

Q: So, keeping things separated and monitoring my reports. Anything else I should be aware of? Maybe a secret tip for turbocharging my business credit?

A: Here’s a little insider secret: consider using a “vendor credit builder” account. These are specifically designed to help you establish credit. Essentially, you make small purchases from them and repay them on time, building a positive payment history. Think of it as a training wheel for your business credit! Also, be patient. Building strong business credit takes time, just like training a puppy. But the rewards are well worth the effort.Q: Okay, sounds promising! Final words of wisdom for budding entrepreneurs looking to conquer the world of business credit?

A: Embrace the process! Building business credit is an investment in your future success. It opens doors to opportunities you might not even realize exist. Stay organized, be diligent, and think of it as creating a financial foundation that will support your dreams for years to come. and remember, every treat (on-time payment) counts! Good luck, and happy building!

wrapping Up

So, you’ve laid the foundation. You’ve learned the blueprints. You’ve got the tools in hand to start building your business credit from the ground up. Remember, a strong business credit profile isn’t a sprint, it’s a marathon. It requires patience, diligence, and a consistent commitment to responsible financial practices. Think of it as cultivating a valuable asset,one that will blossom over time,unlocking opportunities and empowering your entrepreneurial journey.Now, go forth and build something remarkable, brick by financial brick. The future of your business, and its access to growth, depends on it.