Imagine waking up in a maze, the walls built of numbers you don’t recognize, whispers of obligation echoing around you. This maze is debt, and sometimes, those numbers aren’t even real. Hidden within its intricate design is a secret weapon, a way to challenge the legitimacy of your perceived financial prison. That weapon is debt validation. This isn’t about shirking responsibilities, but about demanding transparency, understanding your rights, and ensuring that every penny you’re asked to pay is rightfully owed.So, take a deep breath and prepare to navigate the labyrinth. It’s time to unlock the power of debt validation and discover what you need to know to fight back against inaccuracies and reclaim control of your financial future.

Table of Contents

- Unlocking Your Rights: Understanding Debt Validation

- Beyond the Bill: Identifying Errors and Inconsistencies

- Crafting Your Validation Request: A Step by Step Guide

- What Happens Next: Evaluating the Creditor’s Response

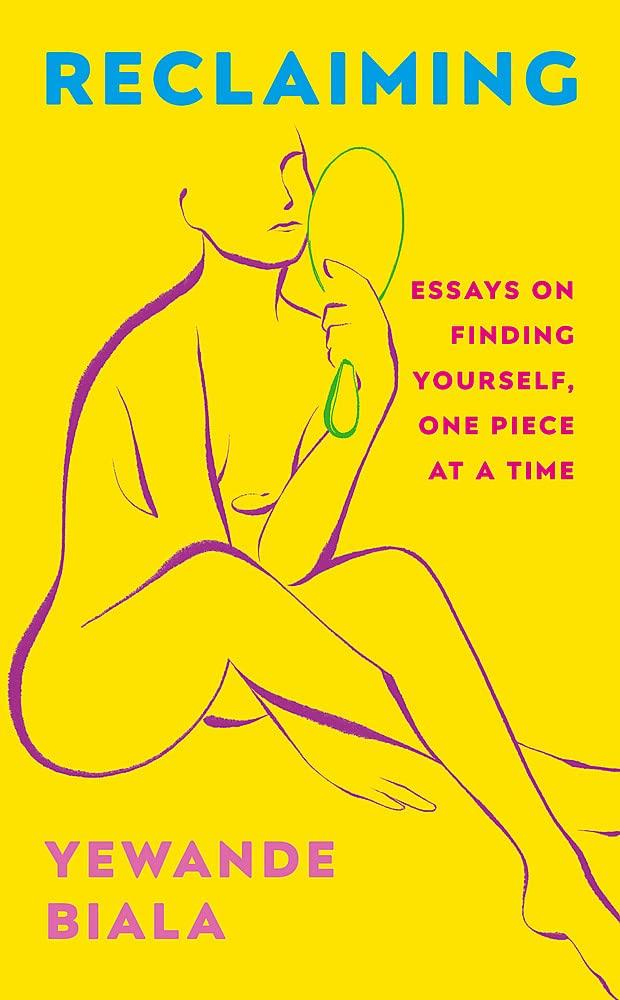

- reclaiming control: Your Options After Validation

- Q&A

- Wrapping Up

Unlocking Your Rights: Understanding Debt Validation

Imagine a world where every bill you receive is automatically assumed correct. That’s essentially how debt works… until you take action. Debt from credit cards, medical bills, or even old loans can sometimes contain errors, be inflated, or even be completely illegitimate. This is where the magic of debt validation comes in: a legal right that empowers you to question the validity of a debt and demand proof.

Think of it as your detective moment! When a debt collector contacts you, don’t just blindly accept the amount they claim you owe. Exercise your right to request validation. This means the collector must provide you wiht documents demonstrating the debt is indeed yours, the amount is accurate, and they have the legal right to collect it. This could include:

- A copy of the original agreement or contract

- An accounting of the debt, showing how it has changed over time

- The name of the original creditor

Why is this so powerful? Because if the debt collector can’t provide adequate proof within a specific timeframe (usually 30 days), they are legally obligated to stop collection efforts. It’s like holding a ”get out of jail free” card for your finances! Even if the debt is ultimately valid,the process can buy you valuable time to strategize and explore your options.

Still unsure? Here’s a speedy overview of potential outcomes:

| Scenario | Debt Collector Response | your Next Step |

|---|---|---|

| Debt validated | Provides documentation | Consider payment options or negotiate |

| Debt Not Validated | Fails to provide documentation | Debt collection stops |

| Debt Partially Validated | Provides some, but not all, documentation. | Negotiate based on the confirmed information. |

Beyond the Bill: Identifying Errors and Inconsistencies

Unearthing Discrepancies: Where Did This Number Even Come From?

Debt validation isn’t just about confirming you owe money; it’s about ensuring the amount, the interest rate, and even the creditor are accurate. Often,debts are sold and resold to various collection agencies,and vital information can be lost or misconstrued in the process. This can lead to inflated amounts,incorrect interest calculations,or even debts attributed to the wrong person. Think of it as peeling back the layers of an onion – each layer revealing potential errors that could save you serious money and protect your credit score.

Digging Deeper: common Errors to Watch for

So, what exactly are you looking for when you request debt validation? Here’s a glimpse into the potential pitfalls:

- Incorrect Account Number: A mismatch can indicate the debt isn’t yours.

- Inflated interest Rates: Collection agencies must prove the interest rate aligns with the original agreement.

- Phantom Fees: Watch out for collection fees or other charges not outlined in the initial contract.

- Statute of Limitations Violations: Collectors can’t sue you for very old debts beyond the statute of limitations.

Demanding Proof: Turning the Tables on Collection Agencies

Debt validation places the burden of proof squarely on the shoulders of the collection agency. they must provide concrete evidence, not just vague statements or assumptions. this is where the power truly shifts. If they can’t substantiate the debt with documentation like a copy of the original contract, payment history, and detailed breakdown of the amount owed, they may be legally obligated to cease collection efforts. Here’s a quick look at what valid documentation *might* look like:

| Document | Purpose | Potential Issue |

|---|---|---|

| Original contract | Proves the debt existed. | Missing signature, altered terms. |

| Payment History | Shows payments made. | Payments not credited. |

| Assignment of Debt | Legitimizes collection agency. | Missing or invalid assignment. |

Inconsistencies: The Red Flags You Can’t Ignore

Even seemingly small differences can raise red flags. Is the creditor name slightly off? Does the address listed match your records? Are there discrepancies between the amount you remember owing and what the collection agency claims? These inconsistencies can be the key to disputing the debt and perhaps avoiding a negative impact on your credit. Remember, it’s your right to question anything that doesn’t seem right.

Crafting Your Validation Request: A Step by Step Guide

Embarking on the debt validation journey requires a well-structured request. Think of it as your formal introduction to the debt collector, setting the stage for transparency and accountability. Avoid emotional language and stick to the facts. state clearly that you are requesting validation of the debt and are not admitting duty for it. This crucial disclaimer protects your rights during the process. Your validation request is the foundation upon which your defense against potentially inaccurate or unjust debt collection practices is built.

Here’s a breakdown of essential elements to include:

- Your identifying information: Full name, current address, and any previous addresses associated with the debt.

- The debt collector’s information: Company name and address.

- Debt details: Account number (if available), original creditor’s name (if known), and the alleged debt amount.

- Specific requests: Clearly state what documentation you require to validate the debt.

Think of the documentation you need as puzzle pieces and you are trying to find out the big picture.Here are some examples of documents you can request from the creditor:

.wp-table {

border-collapse: collapse;

width: 100%;

}.wp-table th, .wp-table td {

border: 1px solid #ddd;

padding: 8px;

text-align: left;

}.wp-table th {

background-color: #f2f2f2;

}

| Document Request | Purpose |

|---|---|

| Original account Agreement | To confirm you agreed to the terms and conditions. |

| Payment History | To verify where payments were applied correctly. |

| Itemized Billing Statements | To understand the breakdown of charges and fees. |

mail your validation request via certified mail with return receipt requested. This provides proof that the debt collector received your letter. Keep a copy of your request letter and the return receipt for your records. Association is key throughout this process. With a carefully crafted validation request, you’re well on your way to exercising your rights and resolving debt disputes effectively.

What happens Next: Evaluating the Creditor’s Response

You’ve fired off your debt validation letter – congratulations! Taking proactive control of your financial situation is a huge step. Now, the waiting game begins. The creditor has a limited timeframe to respond, usually 30 days. What arrives in your mailbox (or inbox) at the end of that period will determine your next move. Don’t expect an immediate admission of defeat from them. They may attempt to fulfill your request in various ways, with varying degrees of success.

Their response could range from a complete verification of the debt, including copies of the original contract, payment history, and proof they have the legal right to collect, to a vague assertion that the debt is yours. or, they might simply ignore your request altogether. Ignoring your request, or sending a deficient response, is a big win for you! It significantly strengthens your position should you choose to dispute the debt further. Here’s what you should be looking for in their response:

- Complete Documentation: Did they provide all the documents you requested, and are those documents legible and complete?

- Accuracy of Information: Does the information match your records (if you have them) or your memory of the debt? Are there any discrepancies in the amount owed, the account number, or the original creditor?

- Legal Standing: Have they clearly demonstrated they have the legal right to collect the debt? This is especially vital if the debt has been sold to a collection agency.

Let’s break down some potential responses and how to react. A thorough validation is what you’re aiming for, but often you’ll get something less complete – potentially opening new avenues for challenges. If, such as, the debt collector doesn’t provide concrete information, you may want to cease communications with the debt collector, so they don’t have the opportunity to provide you with more information to validate. If the collector has violated the FDCPA statute of limitations, or is illegally collecting the debt, consult an attorney to understand your options.

| Creditor’s Response | Possible Action |

|---|---|

| Full Validation Received | Assess and plan for payments or negotiation. |

| Incomplete Validation | send a follow up and/or consult with legal advisor. |

| No Response Received | Account is unverified.Consider your chances for accomplished dispute. |

Reclaiming Control: Your Options After Validation

So, the debt collector validated the debt.Now what? Don’t feel defeated! Validation, while confirming the debt exists, also clarifies its details, which is invaluable. This newfound clarity is your springboard to taking decisive action. Think of it as the enemy showing you their hand – you now know what you’re up against and can strategize accordingly.

Your next moves depend entirely on your financial situation and appetite for risk.Essentially, you have three main paths to consider: negotiating a settlement, challenging the debt’s legality, or paying the debt in full. Each option comes with its own set of benefits and drawbacks. Choosing the right path requires careful consideration of your budget, credit score goals, and legal rights.

Let’s break down those options:

- Negotiate a Settlement: Frequently enough, debt collectors are willing to accept less than the full amount owed to close the account. Use your validated debt information to negotiate a lower settlement.

- Challenge the Debt’s Legality: If you believe the debt is inaccurate or legally unenforceable, you may have grounds to challenge it. This could involve proving identity theft or the expiration of the statute of limitations.

- Pay the Debt in Full: While potentially the least appealing upfront, paying the debt in full immediately stops further accumulation of interest and associated fees.

Here’s a simplified comparison to help you visualise your choices:

| Option | Pros | Cons |

|---|---|---|

| Negotiate Settlement | Reduced debt, faster resolution. | Still impacts credit, requires negotiation skills. |

| Challenge legality | Potential debt dismissal. | Requires strong evidence, can be time-consuming. |

| pay in Full | Eliminates debt immediately. | Requires available funds, highest upfront cost. |

Q&A

The Power of Debt Validation: What You Need to Know - Q&A

Okay, so I’m seeing this “Debt validation” thing all over. Sounds…powerful. But also, a bit intimidating. What exactly is it?

Think of debt validation as your financial superpower shield. It’s your right to demand proof from a debt collector that they actually own the debt they’re trying to collect, and that the amount they’re claiming is accurate. It’s essentially asking them to “show their work” before you hand over your hard-earned cash.

So,it’s basically saying,”Prove it!”? dramatic,I like it. But won’t they just… prove it, and then I’m stuck? what’s the advantage?

While they might prove it, you’d be surprised how frequently enough they can’t. Debt can change hands multiple times, and in the process, paperwork can get lost, information can become inaccurate, or the debt might not even be legally enforceable anymore. Debt validation forces them to do their due diligence, and if they can’t, you could be off the hook! The advantage is control – regaining control over your financial situation.

Gotcha. So,when do I unleash this debt validation superpower? Is there like,a Bat-Signal for debt?

Ideally,you should activate your “validation vision” immediately after being contacted by a debt collector. The sooner you demand validation, the better. Think of it as a pre-emptive strike to protect yourself from potentially illegitimate or inaccurate claims.

Alright, I’m ready to fight! What kind of proof should I be demanding? What does a good validation look like?

You want them to provide documentation that clearly links you to the original debt. This includes things like the original creditor’s name, the original account number, the date the debt was incurred, the amount of the original debt, and evidence that the debt collector has the legal right to collect on your behalf. Just a summary of the debt isn’t enough. You’re looking for documented proof.

Sounds like a treasure hunt for them! What happens if they can’t provide this treasure? I’m envisioning confetti and debt forgiveness dances…

Confetti might potentially be premature,but if they fail to provide valid documentation within the specified timeframe (usually 30 days),they are legally obligated to cease collection efforts. This means they cannot contact you about the debt anymore, and they can’t report it to credit bureaus. This provides a critically important opportunity to improve your credit report and potentially avoid paying an illegitimate debt.

Okay,this feels a little too good to be true. What are the common pitfalls? What dragons do I need to slay in the debt validation kingdom?

One common pitfall is assuming that silence equals victory. Just because a debt collector doesn’t respond immediately doesn’t automatically mean the debt is invalid. Follow up! Another common mistake is not keeping records of everything you send and receive. keep copies of your validation request and any documentation you receive from the debt collector. This will be essential if you need to escalate the issue.

This is all incredibly helpful. Any final words of wisdom for aspiring debt validation warriors?

Remember, you’re not alone in this. There are resources available to help you navigate the debt validation process, including consumer protection agencies and non-profit credit counseling organizations. Don’t be afraid to seek guidance! And most importantly, understand your rights, assert them confidently, and never let anyone bully you into paying a debt without proper validation. You have the power!

Wrapping Up

So, the story doesn’t end with debt collection notices piling up.Armed with the knowledge of debt validation, you now hold a powerful pen, ready to rewrite your financial narrative. Remember, demanding proof isn’t just a right; it’s a crucial step towards ensuring accuracy, fairness, and control over your financial well-being. Don’t let the uncertainty of debt weigh you down. Rather, embrace the power of validation, ask the tough questions, and pave the way for a future where you are not defined by your debt, but empowered by your informed and confident choices. It’s your right – claim it.