Have you ever stared at a credit score, feeling like it’s harboring a grudge? A few late payments can leave a mark, turning what used to be a financial friend into a formidable foe. It’s a disheartening reality many face, but here’s the good news: your credit score, while sensitive, isn’t etched in stone. Consider those late payments a stumble, not a complete knockout. This isn’t about dwelling on the past; its about crafting a comeback. This article dives into the practical strategies and actionable steps you can take to rebuild your credit, transforming those past financial fumbles into a future were your score shines bright once again. Let’s get started on the journey to a stronger financial you.

Table of Contents

- Understanding the Damage: How Late Payments Impact Your Score

- Crafting a Realistic Repayment strategy

- Negotiating with Creditors: Exploring Options for Relief

- Budgeting for Success: Avoiding Future Delays

- Credit Repair strategies: disputing Inaccuracies and Building Anew

- Monitoring Your Progress: Celebrating Small Victories

- Q&A

- To Wrap It Up

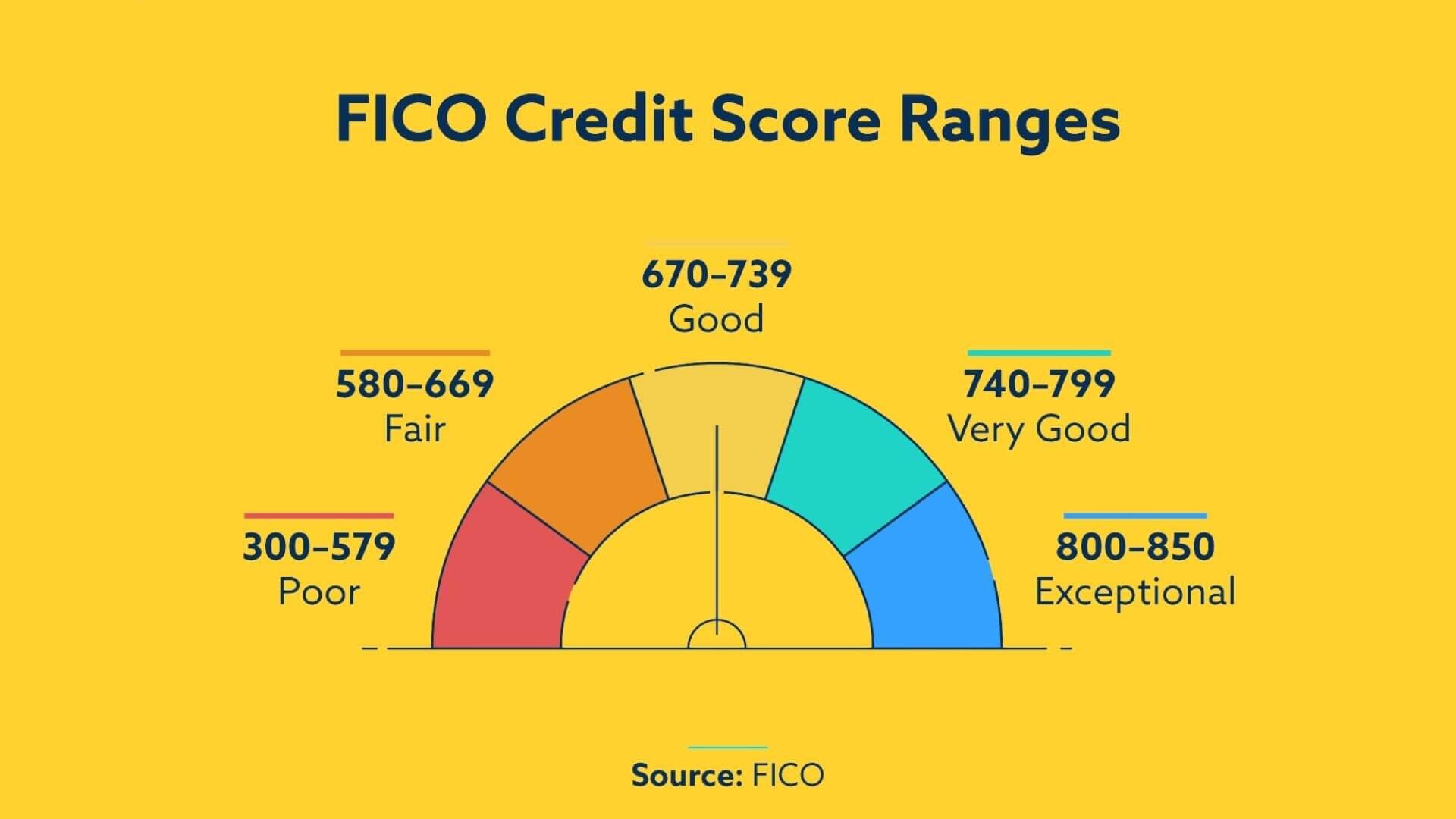

Understanding the damage: how Late Payments Impact Your score

Late payments are like little earthquakes shaking the foundation of your creditworthiness. Each one sends ripples of negative impact through your credit report, perhaps lowering your score and making it harder to secure loans, rent an apartment, or even get approved for a credit card in the future. The severity of the quake depends on factors like how late the payment was, how often you’ve missed payments in the past, and the overall health of your credit history. Think of your credit score as a delicate ecosystem; even a minor disruption can throw things out of balance. The longer you wait to address a late payment, the deeper the cracks become, making the rebuilding process more challenging.

To get a clearer picture, let’s look at a simplified example of how late payments can effect your credit score. Remember that actual impact varies depending on your individual credit profile.

| Payment Status | Potential Impact | Consequences |

|---|---|---|

| 30 Days Late | Minor Score Drop | Higher interest rates on new credit. |

| 60 Days late | Moderate Score Drop | Difficulty getting approved for loans. |

| 90+ Days Late | Notable Score Drop | Collections accounts, severe borrowing limitations. |

The good news is that late payments don’t haunt your credit report forever.Over time,their impact lessens,and you can take steps to rebuild your credit. Some helpful steps include:

- Set up payment reminders: Avoid future mishaps.

- Consider automatic payments: Automate your finances.

- Catch up on past-due accounts: Immediately act on the late payments.

Crafting a Realistic Repayment Strategy

After the sting of late payments fades, reality sets in. A solid repayment strategy isn’t just about throwing money at the problem; it’s about creating a sustainable plan that aligns with your income, expenses, and overall financial goals. Forget crash diets; this is about building healthy financial habits. Start by honestly assessing your budget. Can you trim expenses elsewhere? Even small savings, when consistently applied, can make a big difference. Consider the debt avalanche vs. the debt snowball method. The avalanche prioritizes debts with the highest interest rates, saving you money in the long run, while the snowball focuses on paying off the smallest debts first for a psychological boost. Choose the approach that best motivates you and fits your financial personality.

Next, negotiate! Don’t be afraid to contact your creditors. Many are willing to work with you, especially if you explain your situation and demonstrate a commitment to repayment. Explore options like:

- Reduced interest rates: Even a small reduction can substantially impact your overall debt.

- Temporary hardship programs: Thes may offer temporary suspension or reduction of payments.

- Modified payment plans: restructuring your repayment schedule could make it more manageable.

To illustrate the potential impact,consider this hypothetical scenario:

| Debt | Original Interest Rate | Negotiated Interest Rate | Potential Savings |

|---|---|---|---|

| Credit Card A | 22% | 15% | Significant |

| Loan B | 10% | 8% | Noticeable |

Remember,rebuilding credit is a marathon,not a sprint. Patience and consistency are key.

Negotiating with Creditors: Exploring Options for Relief

Late payments haunting your credit report? You’re not alone. The sting of dings impacts more than just your ability to borrow. It affects interest rates, insurance premiums, and even job applications. but don’t despair! Rebuilding is absolutely possible, requiring a combination of strategic action and patient diligence. Key to your success will be understanding the damage done and, perhaps more crucially, learning how to minimize its lasting impact.

One often overlooked avenue for restoring your financial health lies in direct communication. Creditors, believe it or not, can be surprisingly understanding, especially when you demonstrate a proactive and honest commitment to rectifying past missteps.Consider these options:

- Goodwill Deletion Request: A polite letter explaining the circumstances behind the late payment (job loss, medical emergency, etc.) and appealing to their understanding.

- Payment Plan Negotiation: if you’re struggling to catch up, explore options for temporarily lowered monthly payments or a revised repayment schedule.

- Debt Validation: Ensuring the debt is legitimate and the creditor has the legal right to collect it from you.

Each strategy demands a personalized approach. What works for one person may not work for another. Here’s a rapid guide to expected outcomes when approaching your creditors:

| Strategy | Likelihood of Success | Time Commitment |

|---|---|---|

| Goodwill Deletion | Low to moderate | Moderate |

| Payment Plan | Moderate to High | Moderate |

| Debt Validation | Low | High |

Budgeting for Success: Avoiding Future Delays

Let’s face it: those late payment notifications stung, and now your credit score is reflecting the past. But dwelling on it won’t magically erase the damage. Instead,think of this as a chance to rebuild your credit into something stronger than before. The good news? You have immense power to shape your financial future. The key is to implement smart budgeting strategies that not only prevent future late payments but actively demonstrate responsible financial behaviour to creditors.

Begin by identifying the leaks in your financial boat. Are those “small” subscriptions draining your budget? Perhaps you’re overspending on entertainment or dining out? Create a realistic budget, and then put these key strategies into action:

- Prioritize Needs Over Wants: Separate essential expenses (rent, utilities, groceries) from discretionary spending.

- Automate Payments: Set up automatic payments for bills to avoid accidental late payments.

- Set Up Payment Reminders: use calendar alerts or budgeting apps to remind you of upcoming due dates.

- Consider a Secured Credit Card: These cards require a security deposit and report your payment activity to credit bureaus, helping you rebuild your credit.

.wp-block-table {

border-collapse: collapse !important;

}

.wp-block-table thead {

font-weight: bold;

}

.wp-block-table td {

padding: 6px 13px;

border: 1px solid #ccc;

text-align: left;

}

.wp-block-table th {

padding: 6px 13px;

border: 1px solid #ccc;

text-align: left;

}

| Month | Payment | On Time |

|---|---|---|

| January | $50 | Yes |

| February | $50 | Yes |

| March | $50 | Yes |

Credit Repair Strategies: Disputing Inaccuracies and Building Anew

Here’s how to tackle the challenge: late payments. Think of them as stumbles, not falls. Your credit score isn’t permanently damaged. It’s time to get back up and rebuild. First, understand the impact. Late payments,especially those over 30 days past due,can significantly lower your score. The older the payment, the less impact it has, thankfully. your immediate action? Avoid further late payments like the plague. Also, consider these crucial strategies:

- Goodwill Letter: A heartfelt plea to the lender, explaining why the payment was late (job loss, medical emergency, unexpected hardship). Sometimes, empathy works.

- Negotiate a “Pay for Delete”: This is a long shot, but some lenders might agree to remove the late payment from your credit report if you bring the account current. Get it in writing!

- Automated Payments: Set it and forget it. Seriously, automate all bill payments to avoid future slip-ups.

Consider the table:

| Strategy | Likelihood of Success | Effort Required |

|---|---|---|

| Goodwill Letter | Low to Medium | Medium |

| Pay for Delete | Very low | High |

| Automated Payments | High | Low |

Now, start building anew. Focus on positive credit behavior: on-time payments, low credit utilization. A secured credit card can be a valuable tool if you have trouble getting approved for a traditional card. Treat it responsibly, and watch your score climb. It’s not an overnight fix,but with patience and persistence,you can rewrite your credit story. Remember:

- Piggybacking: Becoming an authorized user on someone else’s credit card account (with a good credit history) can definitely help improve your score.

- Credit Builder Loans: These loans are specifically designed to help you build credit. You make regular payments, and the lender reports your payments to the credit bureaus.

Monitoring Your Progress: Celebrating Small victories

Okay, you’ve made the commitment. You’re tackling those late payments and actively working towards rebuilding your credit. But credit scores don’t magically rebound overnight. That’s why it’s crucial to track your progress and acknowledge every positive step along the way. Think of it as climbing a mountain – you wouldn’t expect to be at the summit on the first day, would you? Small victories, like successfully disputing an inaccurate negative mark on your report or paying off a small debt entirely, deserve celebration! They prove you’re moving in the right direction and fuel your motivation to keep going.

How do you celebrate these “wins” effectively? First, track your progress. consider using a spreadsheet or a budgeting app to monitor your credit score, debt balances, and spending habits. Document even seemingly minor achievements. For example, did you consistently make on-time payments for three consecutive months? That’s a huge win! Consider treating yourself (responsibly, of course!) to a small reward, like a coffee from your favorite cafe or a new book. Here’s a simple way to visualize how far you’ve come:

| Month | Credit Score | Action |

|---|---|---|

| January | 600 | Secured Credit Card |

| February | 615 | On-Time Payments |

| March | 630 | Debt Consolidation |

Remember to:

- Acknowledge Your Efforts: Give yourself credit for every positive action.

- Set Realistic goals: Break down your larger goals into smaller,more manageable steps.

- Stay Consistent: Consistency is key to long-term success.

- Don’t Compare Yourself to Others: Everyone’s financial journey is unique.

Q&A

Rebuilding Credit After Late Payments: Q&A - Get Your Financial House Back in Order

So, you slipped. A bill got lost in the mail, life got hectic, and now your credit report bears the dreaded mark of a late payment. Don’t panic! It happens to the best of us. But what happens next is what truly matters. We sat down with financial guru,Olivia Rightway,to get the inside scoop on rebuilding your credit after a few unfortunate hiccups.

Q: Okay, Olivia, the damage is done. my credit report has a late payment. Is my financial life ruined forever? Dramatic, I know, but I’m stressing out!

A: Breathe! Absolute ruin is highly unlikely. Think of it like spilling paint. A small splash can be cleaned up, and while it might leave a faint stain for a while, you can definitely prevent it from turning into a Jackson Pollock masterpiece on your entire financial canvas.The key is to act strategically and consistently.

Q: strategically? What does that even mean? I need concrete steps!

A: Here’s your roadmap. First, understand the impact. Late payments can ding your score, especially if they’re recent and significant. Then, start repairing the foundation. That means immediately making all payments on time from this moment forward.Think of it as building a fortress of payment punctuality.

Q: Easier said than done! Sometimes life throws curveballs. What happens if I’m struggling to make payments, even trying my best?

A: Life loves throwing curveballs, doesn’t it? If you’re genuinely struggling, communicate! Contact your creditors. Explain your situation honestly. See if you can negotiate a payment plan or a temporary hardship program.Creditors frequently enough prefer working with you rather than dealing with complete default.Think of it as a financial olive branch – sometimes it effectively works!

Q: What about those “credit repair” companies that promise to erase negative marks from my report? Are they legit?

A: Tread carefully! these companies frequently enough make grand promises that they can’t deliver. The truth is, you can often achieve the same results by working directly with your creditors and taking steps to improve your financial habits. Think of it as learning to bake your own prize-winning cake instead of buying a pre-made one from a questionable vendor. Sometimes, the effort yields the best results.

Q: So, no magical eraser then? Just good ol’ fashioned hard work and responsible budgeting?

A: Precisely! Consider this an opportunity to review your spending habits. Are you living within your means? Are there areas where you can cut back? Think of it as performing a financial audit and identifying areas for improvement. Maybe that daily latte habit needs a time out!

Q: what else can I do to actively improve my credit score while simultaneously making sure things like this don’t happen again?

A: Beyond on-time payments, consider a few strategic moves.Check your credit report regularly (you’re entitled to free reports from each of the major credit bureaus annually) to ensure accuracy and identify any potential hiccups. Keep credit utilization low – aim to use less than 30% of your available credit.And if you’re confident in your ability to manage them responsibly, consider opening a secured credit card to help rebuild your credit history. Think of it as equipping yourself with a financial first-aid kit – always be prepared!

Q: How long will it take to see a significant improvement in my credit score?

A: Patience, grasshopper! Sadly, there’s no magic number. It depends on the severity of the negative mark and your subsequent efforts to rebuild your credit. However, with consistent on-time payments and responsible credit management, you can expect to see improvements within a few months to a year. Think long-term progress, not overnight miracles.

Q: Any last words of wisdom, Olivia, for those of us navigating this credit-rebuilding journey?

A: Don’t get discouraged! rebuilding credit takes time and effort, but it’s entirely achievable.See this as an opportunity to build a stronger, more resilient financial future. And remember, a few late payments don’t define you.your journey towards financial wellness is a marathon, not a sprint. Keep putting one foot in front of the othre, and you’ll reach the finish line!

To Wrap It Up

So, there you have it. The roadmap back to credit-worthy glory isn’t paved with magic beans, but with consistent effort and informed choices. Think of it as a garden you’re tending. The weeds of late payments might have choked the blossoms for a while, but with careful pruning, healthy soil enrichment, and consistent watering (metaphorically, of course, representing diligent payments and smart financial decisions), you can cultivate a vibrant and thriving financial landscape once more. It takes time, patience, and a little bit of elbow grease, but the feeling of financial security flourishing again? That’s a harvest worth waiting for. Good luck sowing those seeds of credit recovery!