forget dusty law books and late nights fueled by lukewarm coffee. In the fast-paced legal world, success hinges on more than just knowing the law. It demands shrewd financial management, strategic business development, and a keen understanding of the evolving economic landscape. But how do lawyers and legal professionals stay ahead of the curve when the very nature of their work often leaves them pressed for time and resources? The answer, in part, lies in leveraging credit. Not just as a necessary evil, but as a powerful tool for professional growth and financial stability. This article explores the nuanced relationship between credit and the legal profession, offering practical insights and strategies for building a strong credit foundation tailored to the unique demands of this dynamic field.

Table of Contents

- Credit Lines as Case Lifelines: Funding Legal Practice

- Mastering Debt: Strategic Borrowing for Legal Professionals

- Navigating Credit Scores: Protecting Your Financial Reputation as a lawyer

- Loans for Law Firms: Expansion and Investment Strategies

- Smart Credit Card Usage: maximizing Rewards and Minimizing Risks

- Refinancing Options: Optimizing Legal Education Debt

- Q&A

- the Way Forward

Credit Lines as Case Lifelines: Funding Legal Practice

Navigating the legal landscape often feels like traversing a financial tightrope. High overhead costs clash with the unpredictable nature of case settlements, creating cash flow challenges that can cripple even the most promising firms. That’s where strategic financing, specifically revolving credit lines, emerge as unsung heroes. Consider them your firm’s financial safety net, ready to deploy resources when and where they’re needed most. They are not just about survival; they are about seizing opportunities:

- Case Advancement: Cover crucial expert witness fees, depositions, and travel expenses without depleting operational funds.

- Marketing and Expansion: Invest in attracting new clients and expanding your practice into new areas.

- Bridging the Gap: secure your firm’s financial stability while awaiting settlement payments.

Here’s a simplified comparison of credit line utilization for various legal scenarios:

| Scenario | Credit Line Benefit |

|---|---|

| Major Litigation | Funding intensive finding |

| Unexpected Downturn | Covering payroll & rent |

| Growth Spurt | Hiring new associates |

The beauty of a credit line lies in its flexibility. Unlike a traditional loan, you only pay interest on the funds you actually use, making it a cost-effective way to manage cash flow. It’s about empowering you to handle complexities of the field without constant worry about your firm’s financial standing. it provides peace of mind:

- Financial Buffer: Provides a cushion against slower payment cycles.

- Negotiating Power: Strengthens your position in settlements.

- Strategic Advantage: Enables proactive management, not reactive firefighting.

Mastering Debt: Strategic Borrowing for Legal Professionals

Navigating the world of finance as a legal professional requires a unique blend of caution and strategic thinking. While debt can feel like a four-letter word (and sometimes is!),understanding how to leverage credit responsibly is crucial for both personal and professional growth.Credit isn’t just about credit cards; it’s about accessing capital for critical investments, managing cash flow, and even building a stronger professional reputation. the key lies in mastering the nuances and making informed decisions that align with your career trajectory.

So, what should legal eagles consider when approaching credit? Think beyond the superficial and delve into strategies tailored for your field. Examples:

- Firm Financing: Securing loans for expansion or technology upgrades.

- Student Loan Management: Exploring refinancing options or income-driven repayment plans.

- Personal Investments: Using credit wisely to build a diverse portfolio.

- Building Business Credit: Establishing a strong credit profile for your firm.

| Credit Type | Potential Use | Key Considerations |

|---|---|---|

| Business Line of Credit | Covering operational expenses | Interest rates, eligibility |

| Credit Cards | Travel rewards and cash back | Payment reminders, APR |

| Personal Loans | Debt Consolidation | APR, Monthly payments |

navigating Credit Scores: Protecting Your Financial Reputation as a Lawyer

In the realm of law,where reputation is paramount,your credit score often whispers louder than your most eloquent arguments. It’s a silent partner, influencing not only traditional loans and mortgages but also impacting career opportunities and professional licensing in some jurisdictions. Managing this crucial metric isn’t just about securing favorable interest rates; it’s about safeguarding your financial well-being and professional standing. A squeaky-clean credit report demonstrates financial obligation, a trait highly valued in a profession built on integrity and trust. Think of it as your financial resume, constantly being reviewed by various stakeholders. Remember, in the legal arena, appearances matter, and a stellar credit score reinforces the image of a capable and trustworthy professional.

Beyond the surface, a healthy credit score provides notable strategic advantages. It can empower you to:

- Negotiate better rates on practice loans or real estate investments.

- Secure competitive insurance premiums, both personally and professionally.

- Maintain financial flexibility to weather unexpected expenses or seize unique opportunities.

- Potentially influence hiring decisions if your credit history is under review as part of background checks.

Consider these factors when managing and monitoring your credit:

| Score Range | Financial Impact | professional Perception |

|---|---|---|

| 750+ | Excellent Rates & Terms | Responsible & Stable |

| 680-749 | Good Options Available | Generally Favorable |

| Below 620 | Limited & Costly Options | Potential Concerns Raised |

loans for Law Firms: Expansion and Investment Strategies

Fueling growth initiatives and strategic investments often requires capital infusions. For law firms, navigating the nuances of securing the right financial instruments can be a game-changer. Beyond day-to-day operational funding, targeted financing can unlock significant opportunities for expansion, technological advancements, and talent acquisition.Understanding the landscape of available options is paramount. Consider these key areas where strategic borrowing can propel your firm forward:

- Mergers and Acquisitions: Funding strategic partnerships or acquiring complementary practices.

- Technology Upgrades: Investing in cutting-edge legal tech to enhance efficiency and client service.

- Real Estate Expansion: Opening new offices or renovating existing spaces to accommodate growth.

- Marketing and Business Development: Amplifying your firm’s reach and attracting new clients.

- Working Capital Management: Smoothing out cash flow and addressing short-term financial needs.

selecting the appropriate loan structure is as crucial as identifying the need itself. Different lenders cater to specific niches within the legal profession, offering tailored products to suit varying financial profiles and investment goals. Before committing to a particular path, understanding interest rates, repayment terms, and collateral requirements is essential. Here’s a simplified comparison of potential loan types for illustrative purposes:

| Loan Type | typical Use | Key Feature |

|---|---|---|

| Term Loan | Expansion | Fixed repayment schedule |

| Line of Credit | Working Capital | Revolving access to funds |

| SBA Loan | Real Estate/Equipment | Government guarantee |

Smart Credit Card Usage: Maximizing Rewards and Minimizing risks

in the demanding world of law,where billable hours reign supreme and impeccable financial standing is paramount,a credit card can be more than just plastic – it’s a strategic tool. For lawyers and legal professionals,harnessing the power of credit responsibly unlocks a realm of benefits,from optimizing cash flow for those hefty bar exam fees to earning rewards on essential professional development expenses. but tread carefully, for mishandling this financial instrument can led to a quagmire of debt, impacting your credit score and potentially even raising ethical concerns.

Let’s delve into how legal eagles can soar with smart credit card usage:

- Strategic Card Selection: Choosing cards with rewards programs aligned with professional spending (travel,dining,office supplies).

- Timely Payments: Automated payments to avoid late fees and maintain a pristine credit history.

- Expense Tracking: Meticulous monitoring of credit card spending to identify potential overspending and tax-deductible business expenses.

- Leveraging Perks: Utilizing travel insurance, purchase protection, and concierge services often offered by premium credit cards.

| Scenario | Smart Move | risky Move |

|---|---|---|

| Bar Exam Prep | 0% APR Card | High-Interest Card |

| Client Travel | Rewards Card | Personal Debit |

| Office Supplies | Cash-Back Card | Ignoring Due Dates |

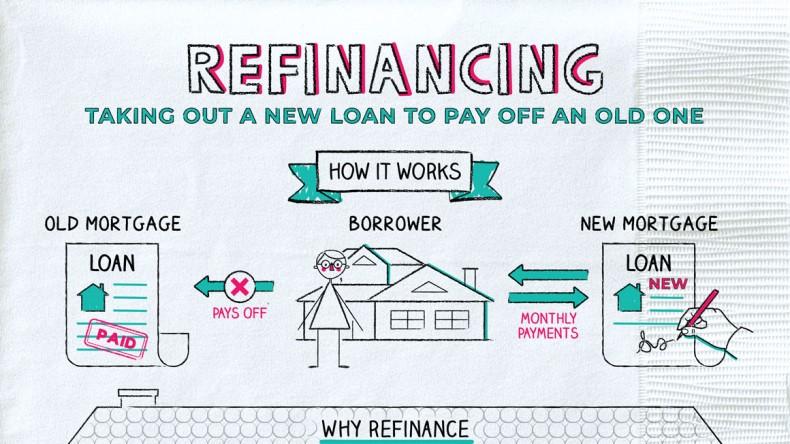

Refinancing options: Optimizing Legal Education Debt

Credit for Lawyers and Legal Professionals

Navigating the labyrinthine world of legal education debt requires more than just a sharp legal mind; it demands a savvy understanding of credit management. Often lawyers and legal professionals find themselves in a unique position. Their earning potential, while promising, is often weighed against considerable student loan burdens. This creates a complex interplay where leveraging credit becomes both a necessity and a strategic tool.Let’s unpack how credit – your credit score,your credit utilization,your overall financial profile – influences your ability to access better loan terms and ultimately,alleviate the pressure of that significant debt.

Consider these options for a moment. Did you know that improving your credit score by even a few points could unlock significantly lower interest rates on refinancing options? Or that strategic debt consolidation could streamline your payments and reduce the overall term of your loans? Here are key areas to explore:

- Credit score enhancement: Simple steps like paying bills on time and keeping credit utilization low can make a huge difference.

- Debt Consolidation: Explore consolidating your federal and private loans for a single, manageable payment.

- Income-Driven Repayment Plans: Understand your eligibility for various IDR plans offered by the government (if applicable).

- Private Refinancing: Shop around for lenders offering competitive rates and terms based on your creditworthiness.

To illustrate potential savings, let’s consider how different credit scores might impact interest rates on a hypothetical loan refinance:

| Credit Score Range | Estimated Interest Rate | Potential Savings |

|---|---|---|

| 750+ (Excellent) | 4.0% | Highest |

| 700-749 (Good) | 5.0% | Moderate |

| 650-699 (Fair) | 6.5% | Lowest |

Q&A

credit for Lawyers & Legal Professionals: The Fine Print You Need to Know

Thinking about leveraging credit? Whether you’re launching your firm, managing cash flow, or investing in your future, navigating the world of credit requires careful consideration. We sat down with a leading financial expert to get the inside scoop.

Q: Legal professionals are frequently enough perceived as financially savvy. Do they really need a crash course in credit?

A: It’s true, a grasp of financial principles is part of the legal toolkit. However, understanding personal and professional credit can be vastly different. we’re talking about the ability to strategically leverage debt to achieve specific goals, understanding nuanced repayment strategies, and avoiding common pitfalls that can impact your long-term financial well-being. Just as you understand contract law doesn’t mean you’re an expert in credit scores and utilization rates.It’s a specialized area, just like any other legal specialty.

Q: What are some of the unique credit challenges lawyers and legal professionals face?

A: The legal field presents several unique hurdles. Think:

Delayed Income: Starting a practice or climbing the ladder often involves periods of low or irregular income, which can impact creditworthiness.

High Student Loan Debt: Significant student loan burdens can affect debt-to-income ratios, making it harder to qualify for other lines of credit.

Ethical Considerations: Publicly documented financial struggles can, in some jurisdictions, reflect poorly on a lawyer’s competency or character, adding an extra layer of pressure.

capital Expenditure for Start-ups: Launching a new firm requires significant capital outlay for office space, software, and marketing, often requiring the use of business credit.

Q: Okay, those are the challenges. What opportunities are there? What advantages do lawyers have regarding credit?

A: Let’s not forget the upsides! A legal education signifies discipline, intelligence, and a commitment to upholding standards – all factors that can impress lenders.Plus:

Earning Potential: Lawyers, generally speaking, have high earning potential, making them attractive borrowers when showing responsible management of finances.

Strong Financial Literacy: The inherent understanding of contractual obligations and due diligence associated with the legal profession provides a good foundation for comprehending credit agreements. Networking: Lawyers often have access to influential networks that can provide access to better loan terms and financial advice.

Q: If a lawyer wants to build or rebuild their credit, where should they start?

A: It all begins with awareness and a strategy:

Know Your Score: Obtain your credit reports from all three major credit bureaus. Identify any errors and dispute them immediately.

understand Your Score: Don’t just look at the number! Understand how it’s calculated. Focus on paying bills on time, keeping credit utilization low (ideally below 30%), and avoiding unnecessary hard inquiries.

Budget, Budget, Budget: Create a realistic budget and stick to it. Track your expenses to identify areas where you can cut back and free up cash flow.

Consider Secured Credit: If rebuilding credit, a secured credit card can be a helpful tool.

Explore Peer-to-Peer Lending: As a lawyer, you might be able to leverage your professional network for peer-to-peer lending opportunities with more favorable terms.Q: What’s the single biggest credit mistake you see lawyers making?

A: Without a doubt, it’s taking their credit for granted. Assuming that a high income automatically translates to a stellar credit profile is a hazardous mindset. Even a high-earning attorney can damage their credit with late payments,overspending,or neglecting to monitor their credit reports. Proactive credit management is the key to maximizing financial flexibility.

Q: Any final advice for lawyers looking to leverage credit effectively?

A: Treat your credit like you would treat a client’s case: with diligence,attention to detail,and a long-term strategy in mind. Don’t be afraid to seek professional financial advice. Many financial advisors specialize in working with high-income professionals and can provide personalized guidance on debt management, investment strategies, and retirement planning. Ultimately,sound credit management is not just about obtaining financing – it’s about securing your financial future. It’s time well spent.

The Way Forward

So, there you have it. Navigating the world of credit for legal professionals might feel like wading through a particularly complex statute. But with careful planning, informed decisions, and a dash of financial strategy (perhaps a well-placed legal pad?), you can leverage credit to build a stronger future for yourself and your practice. Remember, just like a meticulously crafted argument, a solid credit foundation can be a powerful asset in achieving your professional goals. Now go forth and conquer (credit responsibly, of course!).