Imagine your credit score as a finely tuned orchestra, each instrument representing a different aspect of your financial health. A missed payment is a screeching violin solo, a low credit utilization a harmonious cello, and responsible borrowing a well-conducted symphony. Now, picture a brass band storming the stage – blasting unpredictable, ear-splitting notes. That, in essence, is cryptocurrency wading into the world of credit. This relatively new digital asset, with it’s volatility and complexities, is forcing us to reconsider the existing framework of credit scoring and lending. Are we ready to integrate this new,dynamic element? What are the potential rewards and dangers of mixing decentralized finance with our traditional,highly regulated credit system? this article delves into the intricate relationship between cryptocurrency and credit,exploring the implications for both individuals and the institutions that shape our financial landscape. Prepare to navigate the uncertain,yet potentially transformative,intersection of digital currency and credit.

Table of Contents

- Navigating the Crypto Credit Maze

- Understanding the Lending Landscape

- Decentralized Finance and Your Credit Score

- Risks and Rewards of Crypto Backed Loans

- Protecting Your Credit Health in the Digital Age

- Making Informed Decisions About Crypto and Credit

- Q&A

- Future Outlook

Navigating the crypto credit Maze

The allure of digital currencies is undeniable, but have you stopped to consider the potential ripple effect on your credit score? Delving into the crypto sphere without understanding the nuanced implications can lead to unforeseen consequences. Buying and selling cryptocurrency isn’t a direct credit reporting activity.However, the activities you undertake to acquire or leverage your crypto assets can certainly impact your creditworthiness. Think about it:

- Loan Collateral: Using crypto as collateral for a loan? A default could tank your score.

- Credit Card Crypto Rewards: Missing payments on a crypto rewards card? Prepare for negative impacts.

- Crypto Lending Platforms: Borrowing against crypto holdings? Late payments get reported.

the intersection of digital assets and traditional finance is still being defined,and the rules of engagement are constantly evolving. Hear’s a quick look at some common crypto activities and their possible credit impacts:

| Activity | Potential Impact |

|---|---|

| Crypto Trading (via cash account) | Generally,Neutral |

| Crypto-Backed Loan Default | Considerably Negative |

| Late Payments on Crypto Credit Card | Negative |

| Margin Trading Losses (covered by credit line) | Potentially Negative |

Understanding the Lending Landscape

The rise of cryptocurrency has introduced a engaging new dimension to the world of lending. No longer is creditworthiness solely persistent by traditional metrics like credit scores and debt-to-income ratios. The integration of digital assets as collateral,or even as a primary source of income,is forcing lenders to re-evaluate their risk assessment methodologies. This paradigm shift presents both opportunities and challenges, demanding a deeper understanding of how these volatile assets can impact loan repayment, collateral liquidation, and overall market stability.

Specifically, understanding the credit implications means navigating uncharted waters. Consider,such as,the challenges:

- Volatility Risk: Cryptocurrencies are notoriously volatile. A sudden market downturn could significantly decrease the value of crypto-backed loans.

- Regulatory Uncertainty: The legal landscape surrounding cryptocurrency is constantly evolving, creating potential risks for lenders and borrowers.

- Valuation Difficulties: Accurately valuing certain cryptocurrencies, especially less established ones, can be complex and subjective.

To illustrate how different cryptocurrencies might impact lending rates,consider this hypothetical scenario:

| Cryptocurrency Collateral | Perceived Risk level | Impact on Interest Rate |

|---|---|---|

| Bitcoin (BTC) | Moderate | Slight increase |

| Ethereum (ETH) | Moderate | Slight increase |

| Dogecoin (DOGE) | High | Notable increase |

| newly Launched Altcoin | Very High | Potentially Unlendable |

Decentralized Finance and Your Credit Score

The world of DeFi, with its glittering promises of decentralized lending and borrowing, often feels light years away from the humdrum reality of credit scores. But are these two worlds truly separate? The implications of cryptocurrency involvement on your credit rating are more nuanced than you might think. While simply owning Bitcoin won’t magically raise or lower your score,engaging in DeFi activities – particularly borrowing and lending – can indirectly impact your creditworthiness.

Let’s break down some key areas to consider:

- Traditional Loans and Crypto: If you’re using cryptocurrency as collateral for a secured loan from a traditional lender, a default could certainly ding your credit.

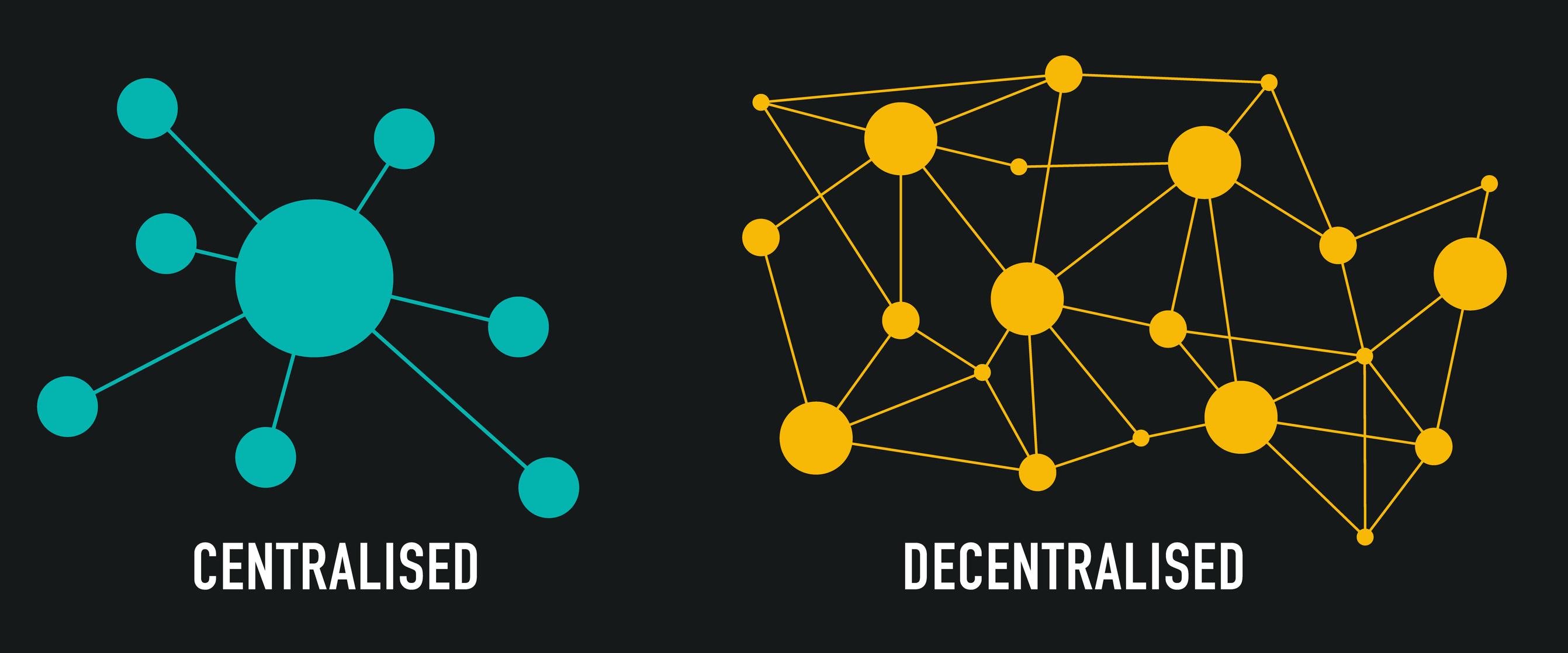

- KYC/AML Compliance: Some centralized crypto platforms that offer lending products might share data with credit bureaus, especially if they’re adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- The Wild West of DeFi: Purely decentralized platforms operating without KYC likely won’t directly report to credit bureaus. However, the impact of significant financial losses in DeFi on your ability to meet traditional debt obligations can still lead to credit damage.

| Scenario | Potential Credit Impact |

|---|---|

| Using Crypto as collateral for a bank loan | Default can lower score |

| Borrowing from a DeFi platform (no KYC) | Indirect (impact on ability to pay bills) |

| Centralized crypto lending platform reports activity | Direct (but less common) |

Ultimately, a responsible approach to DeFi, alongside mindful management of your overall financial health, is the best way to navigate this evolving landscape. Don’t let the allure of high yields blind you to the potential risks and their ripple effects on your credit standing.

Risks and Rewards of Crypto Backed Loans

navigating the world of crypto-backed loans is like walking a tightrope between potentially enormous gains and significant financial pitfalls. On one side, the allure of unlocking liquidity without selling your precious crypto assets can be incredibly tempting. Imagine needing funds for a down payment on a house or to seize a lucrative investment possibility. A crypto-backed loan allows you to keep riding the crypto wave, hoping for even greater gratitude, while accessing much-needed capital. However,the ever-present shadow of volatility looms large.

Think of it this way: it’s a high-stakes game with both dazzling upside and chilling downside. Here’s a quick look at some potential ups and downs:

- Rewards:

- Access to funds without selling crypto.

- potential to profit from crypto appreciation during the loan term.

- Often more accessible than traditional loans (depending on the provider).

- Risks:

- Liquidation of your collateral if the crypto’s value drops below a certain threshold.

- High interest rates compared to traditional loans.

- Potential tax implications on loan interest and crypto gains.

| Scenario | Crypto Value | Outcome |

|---|---|---|

| Bull Market | increases | Profit from crypto + access to funds |

| Bear Market | Decreases | Risk of liquidation |

protecting Your Credit Health in the Digital Age

Cryptocurrency: the Wild West of finance meets the digital frontier. While potentially lucrative,its relationship with your credit health is more nuanced than a simple “buy low,sell high” ideology. Direct interaction is often limited. buying crypto with a credit card, for example, can impact your credit utilization ratio, which makes up a significant portion of your credit score. High utilization (maxing out or coming close to maxing out those cards) can signal risky behavior to lenders. Other points to chew on:

- Cash Advances: Some credit card companies classify crypto purchases as cash advances,triggering higher interest rates and fees.

- Reporting Issues: Delays or errors in reporting crypto transactions could lead to temporary inaccuracies on your credit report.

- Loan Collateral: Using crypto as collateral for loans? A sudden crypto crash can trigger a margin call, leading to forced liquidation of your assets, and if you can’t cover the debt, a negative impact on your credit.

Beyond direct purchases, be wary of the knock-on effects. Scams promising astronomical returns are rampant in the crypto space.Losing money to these (or even legitimate but failed crypto ventures) could lead to missed payments on debt obligations, which will directly damage your credit score.The decentralized nature of crypto also introduces risks that are frequently enough borne by the user. Think carefully before diving in headfirst.The following table shows an example of potential pitfalls and their credit implications:

| Scenario | Potential Consequence | Credit Impact |

|---|---|---|

| Crypto ATM Fee overdraft | Bounced Transaction Fee | Reduced Credit Score |

| Margin Call Liquidation | Unpaid Loan Balance | Significant Credit Score Drop |

| Crypto Scam Loss | Missed Debt Payments | Negative Credit History |

Making Informed decisions About Crypto and Credit

Navigating the intertwined worlds of digital currencies and credit scores can feel like traversing a high-stakes maze. One wrong turn,and you might find your creditworthiness jeopardized. While cryptocurrency investments themselves don’t directly impact your credit score, the ripple effects of your crypto activities certainly can.Missed payments on credit cards used to buy crypto,taking out loans against your crypto holdings,or even falling prey to scams that drain your bank accounts can all have significant consequences. Understanding these connections is paramount.

So, how can you stay on the right track? Start by implementing these key strategies:

- Never fund crypto investments with credit card debt.

- Be wary of lenders offering loans secured by your crypto.

- Protect your digital wallets with strong passwords and two-factor authentication.

- Report any suspicious activity instantly to protect your financial health.

Consider also the following hypothetical impact matrix:

| Scenario | Potential Credit Impact |

|---|---|

| Using credit card for crypto purchase and can’t repay. | Negative |

| Taking a loan based on crypto assets. | Depends on repayment |

| Just holding crypto in a wallet. | Neutral |

Q&A

Cryptocurrency & Credit: Decoding the Digital Debt

Q&A to separate fact from fiction, and navigate the crypto curveball in your credit score.

Q: Okay, let’s cut to the chase. Does buying Bitcoin automatically torpedo my credit score? Am I suddenly doomed to a life of predatory APRs because I own some Dogecoin?

A: Thankfully, no.Simply owning cryptocurrency, whether a little or a lot, doesn’t directly effect your credit score. Your credit score reflects your history of borrowing and repaying money. Holding a digital asset, in and of itself, isn’t a loan or a line of credit. Think of it like collecting stamps. Fascinating, perhaps, but not something that directly impacts your ability to pay your bills.

Q: But I’ve heard whispers of “crypto loans.” What’s all that about? Is that where my credit gets dragged through the mud?

A: here’s where things get interesting. crypto loans, collateralized by your cryptocurrency holdings or used to purchase more crypto, can have an impact. If you borrow money and consistently fail to repay it on time these delays or defaults will be reported to the credit bureaus like any other loan.this could negatively impact your credit score. Conversely, responsible repayment could potentially, though less predictably, contribute positively to your credit history.

Q: So, crypto loans are basically a financial tightrope walk. Risky business! Are ther hidden dangers I should be aware of beyond simply defaulting?

A: Absolutely. The volatility of the crypto market adds an extra layer of complexity.Imagine taking out a loan against your bitcoin that’s suddenly halved in value. You could face a margin call, forcing you to liquidate your holdings to cover the debt. This fire sale could hurt your investment strategy and, in extreme cases, contribute to your inability to repay the loan, creating a double whammy for your credit.

Q: Right, that volatile dance floor is… terrifying. what about using my credit card to buy crypto? Does that count as “borrowing” and therefore affect my credit?

A: Typically,yes! Buying cryptocurrency with a credit card is often treated as a cash advance. Cash advances usually come with higher interest rates than regular purchases, and they can quickly inflate your credit utilization ratio, which is a key factor in your credit score.High credit utilization – spending a large percentage of your available credit – signals risk to lenders.

Q: Okay, got it. High interest, potential credit score damage. So, using credit cards for crypto is generally a bad idea?

A: Generally, it’s best to proceed with extreme caution. If you’re considering it, understand the cash advance fees, interest rates, and potential impact on your credit utilization. Furthermore, some credit card companies may not even allow purchases of cryptocurrencies.

Q: What about using crypto to pay off my credit card debt? Is that a secret backdoor way to “crypto-fy” my credit score for the better?

A: Here’s where the dream meets reality.While some platforms are exploring ways to bridge the gap between crypto and traditional finance, directly paying your credit card bill with crypto isn’t widely available… yet. However, you could, for example, use a cash advance to use crypto. You could convert your crypto into fiat currency and make a payment. However, as mentioned before, this option might not be optimal due to fees and interest rates.

Q: So, the bottom line? What’s the golden rule for keeping crypto from becoming a credit score kryptonite?

A: Prudence is paramount. Keep your crypto investments separate from your credit profile. Avoid using credit cards to purchase crypto unless you’re absolutely confident in your ability to repay the balance promptly. Carefully evaluate the terms and risks associated with crypto loans. Treat crypto like the potentially rewarding,but definitely wild,ride it is. Your credit score will thank you for it.

future Outlook

So, where does this leave us? perhaps straddling the fence between the tangible comfort of credit scores and the ethereal promise of decentralized finance.The future of crypto and its relationship with credit remains a fascinating, dynamic landscape. Whether you see it as a disruptive force destined to revolutionize finance, or a risky experiment with the potential for unforeseen consequences, one thing is clear: its impact is unavoidable. The key, as always, lies in informed consideration, responsible navigation, and a willingness to adapt as this digital frontier continues to evolve. Keep learning, keep exploring, and keep a close eye on that fluctuating ledger – the story of crypto and credit is far from over.