imagine your debt is a mischievous gremlin clinging to your back, whispering promises of short-term gratification for the low, low price of… everything you own. That gremlin, dear reader, is powered by interest. Ignore it, and it grows, feasting on your financial well-being. Understanding interest rates isn’t just about cold, hard numbers; it’s about taming that gremlin, about seizing control of your financial destiny. This article isn’t a lecture on personal finance; it’s your guide to demystifying interest rates and their profound impact on debt, empowering you to make informed decisions and finally silence that whispering gremlin for good.

Table of Contents

- Decoding Interest Rates A Smart Borrower’s guide

- Unveiling the ripple Effect Interest Rates and your Debt Burden

- Beyond the Numbers Interest Rate strategies for Financial Wellbeing

- Empowering Your Financial Future mastering Interest Rate Management

- Take Control Now Practical Steps to Minimize Interest Rate Impact

- Q&A

- In Retrospect

Decoding Interest Rates A Smart Borrower’s Guide

Ever feel like interest rates are some kind of secret code the banks are using against you? You’re not alone! Many borrowers feel overwhelmed, but understanding interest rates is the single most powerful tool you have for navigating the world of debt and taking control of your finances. They determine not just how much you borrow but, crucially, how much you’ll ultimately repay.Think of learning about interest rates as leveling up in a financial video game – it unlocks better strategies and bigger rewards.

At its heart, an interest rate is the cost of borrowing money expressed as a percentage. But it’s so much more than just a number. It’s the engine that drives the compounding effect – that magical (or terrifying) force that can either exponentially grow your investments or bury you under a mountain of debt by increasing your balances. Whether it’s a mortgage,student loan,or credit card,the interest rate dictates the pace at which your debt accumulates.Ignoring it is like driving a car blindfolded; you’re likely to crash.

Factors influencing interest rate that affects the debt:

- the Prime Rate: The base interest rate commercial banks use.

- Credit Score: A lower score usually leads to higher rates.

- Loan Term: longer terms frequently enough mean higher overall interest paid, even with lower monthly payments.

To illustrate the real-world impact, let’s consider a hypothetical personal loan scenario.

| Loan Amount | Interest Rate | Loan Term | total Repaid |

|---|---|---|---|

| $5,000 | 5% | 3 years | $5,392 |

| $5,000 | 15% | 3 years | $6,240 |

See the difference? A seemingly small fluctuation in the interest rate can equate to hundreds of dollars in extra payments over the life of the loan. That’s money that could be used for investment, travel, or simply improving your quality of life. So, start decoding! Your financial future depends on it.

Unveiling the Ripple Effect Interest Rates and Your Debt Burden

Ever feel like you’re running on a debt treadmill, putting in the work but staying in the same place? The culprit could be lurking in the shadows: interest rates.These seemingly small percentages have the power to dramatically reshape your financial landscape, determining how quickly (or slowly) you escape the burden of debt. Understanding them isn’t just about number crunching; it’s about gaining control and possibly unlocking years of financial freedom.

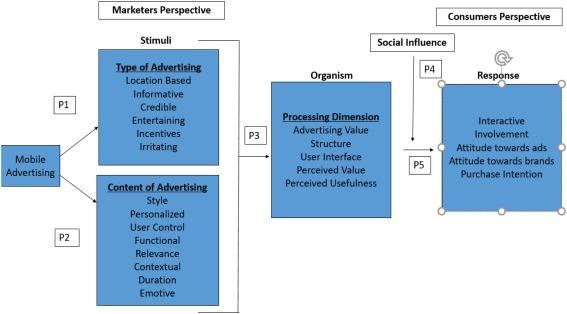

Imagine interest rates as tiny Pac-Men, continuously chomping away at your principal balance. The higher the rate,the hungrier the Pac-Man,and the less of your payments actually go towards reducing what you owe. This is especially true with compounding interest, where interest is calculated not only on the original principal but also on the accumulated interest from previous periods. It can feel like a snowball effect, where your debt grows exponentially over time. some factors to consider include:

- Type of Debt: Credit cards typically have higher interest rates than mortgages or car loans.

- Credit Score: A lower credit score usually results in higher interest rates.

- Economic Conditions: Interest rates are influenced by broader economic trends and central bank policies.

To illustrate how interest rates impact your debt repayment, consider these examples:

| Loan Amount | Interest Rate | Monthly Payment (3 years) | Total Interest Paid |

|---|---|---|---|

| $5,000 | 5% | $150.69 | $424.84 |

| $5,000 | 15% | $173.33 | $1240.02 |

As you can see, a seemingly small difference in interest rates can result in significantly higher interest payments over the life of the loan. Knowledge is power. By understanding the intricacies of interest rates, you can make informed decisions about borrowing, debt management, and ultimately, building a secure financial future. Take the time to analyze your current debts, explore options for lower interest rates (such as balance transfers or debt consolidation), and create a repayment plan that aligns with your financial goals.

Beyond the Numbers Interest Rate Strategies for Financial Wellbeing

We frequently enough here about interest rates, but how many of us truly understand their profound impact on our financial lives, particularly when navigating the often-murky waters of debt? Ignorance, in this case, isn’t bliss; it’s expensive. Understanding the nuances between APR (Annual Percentage Rate) and simple interest, for instance, can be the difference between aggressively paying down debt and simply treading water. APR reflects the actual cost of borrowing, including fees, while simple interest only accounts for the principal amount. Making informed decisions requires knowing which figure accurately illustrates your financial burden.

The insidious nature of compound interest can simultaneously be your worst enemy when dealing with debt and your greatest ally when investing. Think of it like this: debt with high,compounding interest is a snowball rolling downhill,gaining size and momentum with each turn. The longer you delay tackling that debt, the more overwhelming it becomes. To truly grasp this, examine your existing debts. Are you aware of the interest rates attached to each? consider strategies, such as the debt avalanche or snowball method, to prioritize repayment based on interest rates or psychological wins. These strategies can help you systematically chip away at your debts and minimize the long-term interest burden.

Let’s consider some scenarios: Imagine you have two credit cards, one with an 18% APR and another with a 22% APR. Applying the ‘avalanche’ method means attacking the 22% APR card first, regardless of the balance. Alternatively, the ‘snowball’ method focuses on paying off the card with the smallest balance first, providing a speedy win, even if its interest rate is lower. Understanding the long-term financial impact of each approach is crucial.

| Debt Scenario | Interest Rate | Repayment Strategy | Potential Saving* |

|---|---|---|---|

| Credit Card A | 18% | Avalanche (First Priority) | $500 |

| Credit Card B | 22% | Avalanche (second Priority) | $0 |

| Student Loan | 6% | Last Priority | N/A |

*Savings calculated over a 3-year repayment period compared to a non-prioritized approach. Actual savings may vary.

Beyond focusing solely on high-interest debt, be mindful of how even seemingly small differences in interest rates can accumulate significantly over time. Are you aware of refinancing opportunities that might lower your existing interest rates? Explore options such as:

- Balance Transfers: Shifting high-interest credit card balances to cards with lower introductory rates.

- Debt Consolidation Loans: Combining multiple debts into a single loan with a potentially lower interest rate.

- Negotiating with Creditors: Directly contacting creditors to negotiate lower interest rates or payment plans.

Empowering Your Financial Future Mastering Interest Rate Management

Imagine your financial life as a vast ocean. Interest rates? They’re the tides, constantly shifting and influencing your journey. Ignoring them is like sailing without a compass – you might reach a destination,but the route will be unpredictable and potentially treacherous. Understanding how these rates impact your debt is not just financial savvy; it’s essential navigation for smooth sailing towards your goals.

Debt, whether it’s a mortgage, a credit card balance, or a student loan, rarely exists in isolation.It’s intertwined with interest rates, which act as a silent multiplier. A seemingly manageable debt can quickly balloon if rates climb too high, eating away at your budget and delaying your aspirations. Think of it like this: you’re meticulously bailing water out of a boat, but a hidden leak (high interest) is steadily replenishing it. Ignoring the leak means endless bailing, never reaching the shore.

To truly grasp the power, consider the compounding effect. High interest rates on credit cards, as a notable example, lead to a snowball effect.Unpaid interest accrues, increasing the principal, which then generates even more interest. Before you know it, you’re trapped in a cycle of debt, struggling to make even the minimum payments. Conversely, understanding how to leverage lower rates, perhaps through refinancing or balance transfers, can free up cash flow, allowing you to invest or pay down debt faster.

Here’s a simplified illustration of how interest rates can affect the total cost of a $10,000 loan:

| Interest Rate | Loan Term (Years) | Total Cost |

|---|---|---|

| 5% | 5 | $11,322 |

| 10% | 5 | $12,748 |

| 15% | 5 | $14,547 |

This table clearly demonstrates the dramatic impact of interest rate fluctuations. To take control, you should:

- Know Your Rates: Regularly check the interest rates on all your debts.

- Shop Around: Compare rates when taking out new loans or refinancing existing ones.

- Prioritize High-Interest Debt: Focus on paying down debts with the highest interest rates first.

Take Control Now Practical Steps to Minimize Interest Rate Impact

Feeling the pinch of rising interest rates? You’re not alone. But knowledge is power, and armed with the right strategies, you can navigate these financial waters with confidence.Let’s move beyond understanding the why and dive straight into the how – empowering you to take immediate action.

Okay, time to roll up your sleeves. Here are some actionable steps you can implement today to mitigate the impact of interest rate hikes:

- Debt Avalanche vs. Debt Snowball: Strategically tackle your highest interest debt first, or gain momentum by paying off your smallest balances.

- negotiate Rates: Contact your кредитор; you might be surprised at their willingness to work with you.

- Balance Transfers: Explore transferring high-interest credit card balances to cards with lower introductory rates.

- Refinance (Carefully!): Consider refinancing mortgages or auto loans, but weigh the long-term costs and potential fees.

Let’s illustrate the impact with a simplified example. Imagine two people,Alice and Bob,each carrying $5,000 in credit card debt:

| Scenario | Alice (Pays Minimum) | Bob (Aggressive Payments) |

|---|---|---|

| Interest Rate | 20% | 20% |

| payment Strategy | Minimum ($100) | $300/month |

| Time to Pay Off | Years (estimated) | ~1.5 Years |

| Total Interest Paid | Substantial | Significantly Lower |

The key takeaway? Proactive management makes a huge difference. Don’t just except interest rates as a fixed reality. Take control by actively managing your debt, exploring your options, and implementing strategies that align with your financial goals. Every step you take, no matter how small, moves you closer to financial freedom.

Q&A

Q&A: Decoding the debt Dance: Why Interest Rates Matter More Than You Think

So, you’re whispering sweet nothings about the importance of interest rates and debt.Intriguing! But why should my average Joe (or Jill) care? Isn’t this just economics mumbo jumbo?

Response: Think of interest rates as the conductor of the financial orchestra. They set the rhythm for everything from buying a house to paying off a credit card. Ignoring them is like attending a concert with earplugs in – you might be present, but you’re missing the whole experience, and probably making some questionable dance moves along the way. for Joe and Jill,understanding interest rates is the key to making smart financial decisions,avoiding crippling debt,and potentially even building wealth. No mumbo jumbo here, just financial empowerment.

Okay, music analogy aside, I hear you. But I already juggle work, family, and Netflix binge-watching. Where do I even begin to wrap my head around interest rates? there are so many numbers!

Response: Don’t panic! Think of it like learning a new recipe. You don’t need to memorize the entire cookbook on day one. Start with the basics. first, learn the difference between APR (Annual Percentage Rate) and interest rate.Think of APR as the total cost of borrowing, including interest and fees, expressed annually.Then, familiarize yourself with the different types of interest rates: fixed vs. variable.Fixed is like a steady drumbeat; variable is more like a jazz solo, prone to improvisation (translation: fluctuation). Resources like online calculators and financial websites are your trusty measuring spoons and cups.

Fixed vs. Variable… Got it! But let’s say I’m already knee-deep in debt,drowning in interest charges. Is understanding this now even useful? Am I not just rearranging deck chairs on the Titanic?

Response: Absolutely not! Understanding interest rates becomes even more crucial when you’re already carrying debt. It allows you to make informed decisions about debt consolidation, balance transfers, and negotiating with creditors. Think of it as learning to pilot a lifeboat while the Titanic is sinking! You can use this knowledge to prioritize which debts to tackle first (hint: usually the ones with the highest interest rates). It can also empower you to create a repayment plan that actually works, breaking free from the cycle of debt.

Alright,you’ve convinced me. Knowledge is power, and financial knowledge is… well, financial power. But what’s the single best takeaway regarding interest rates and debt that everyone should keep tucked away in their back pocket?

Response: This: Compound interest can be your best friend or your worst enemy. When you’re saving and investing,it works in your favor,allowing your money to grow exponentially. But when you’re carrying debt, it works against you, making your balance balloon over time. Understanding this simple principle – whether you’re saving or incurring debt – is the most powerful tool you can possess. Use it wisely, and you can orchestrate your own financial symphony.

In Retrospect

so, the next time you’re faced with a loan offer, a credit card statement, or even just pondering that dream purchase, remember the ripple effect. Understanding interest rates isn’t just about financial literacy; it’s about empowerment.It’s about making informed choices that steer you towards a future where your debt doesn’t dictate your dreams. It’s about taking the reins and riding the wave of compound interest,not being swept away by it.Now, go forth and become a master of your own financial destiny. The power, as they say, is in your rate.